Register now to attend this one-hour webcast featuring top industry leaders from CREW Network, ICSC, NAIOP, and NMHC.

Renters are paying their monthly rent at near-normal levels and millions of renters haven’t been displaced as feared.

Marcus & Millichap is proud to present to market Victorian Apartments, a 152-unit apartment community located in west suburban Montgomery, Illinois

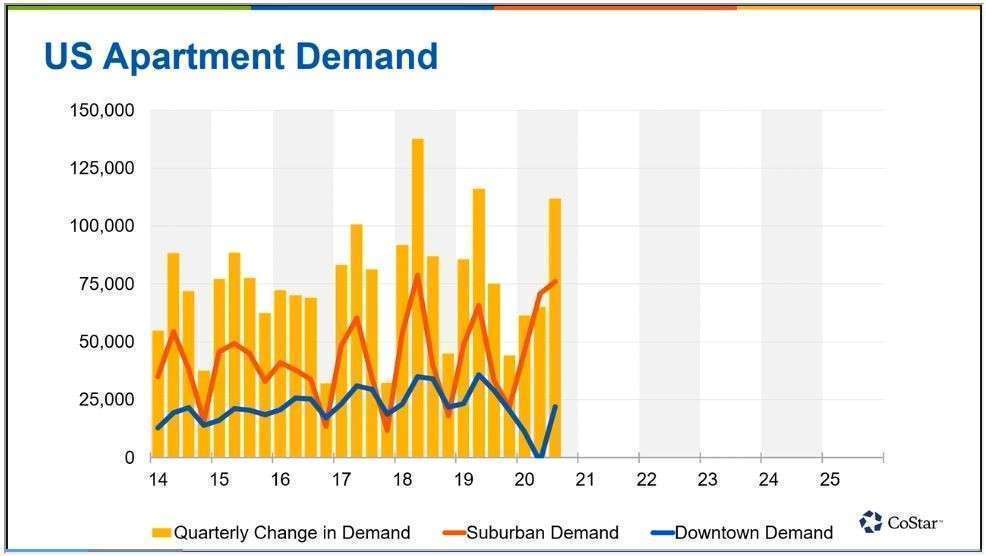

Tenants are moving to the suburbs in droves, according to CoStar’s latest apartment report, and downtown landlords are cutting rents.

Occupied apartments climbed by nearly 147,000 units, outpacing absorption in the second quarter by more than four times. Even more promising, demand in Q3 increased by 8% year-over-year.

A pair of recent reports, one from CoStar and another from Real Capital Analytics (RCA), show that multifamily property continues to see price increases despite the pandemic.