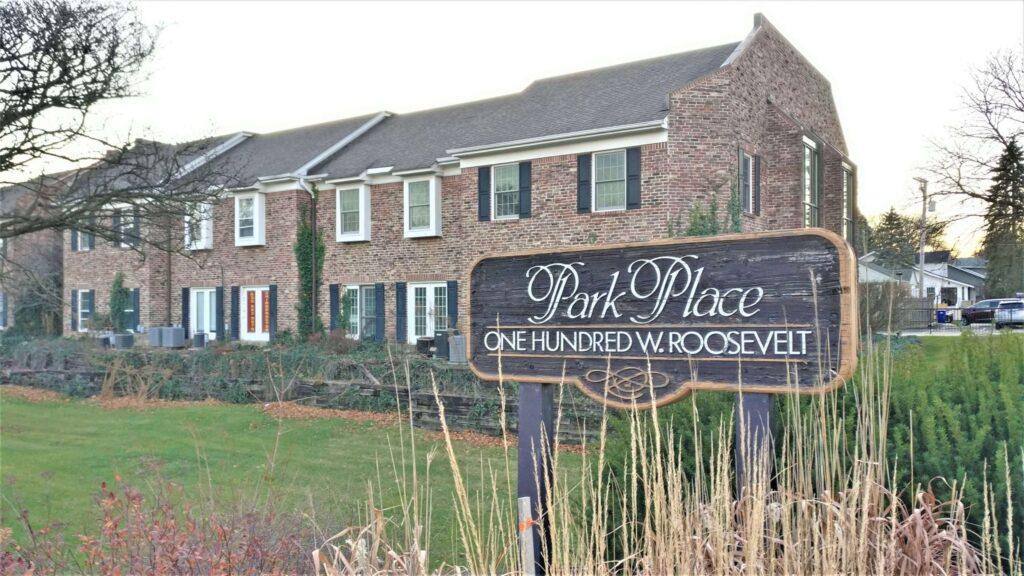

Marcus and Millichap is proud to present Park Place of Wheaton, a wholly owned eight unit office condo property superbly located on highly visible West Roosevelt Rd and South Main Street in downtown Wheaton, IL DuPage County

Tag Archives: Investment

Marcus and Millichap is pleased to present to market this fully occupied 10-unit value-add multifamily offering in Blue Island, Illinois, a southern suburb of Chicago.

Opportunity zones provide tax breaks to investors who transfer recently realized capital gains into qualified funds that sink money into real estate projects and businesses located in specially designated economically distressed areas, with a goal of boosting jobs and housing.

Investors and owners continue to face a dichotomy of sorts. On the one hand, overall economic conditions remain strong….

2018 brought historic changes to the economy, tax laws and real estate markets. The decisions you make today will have dramatic effects on the performance of your investments for years to come. Join Marcus & Millichap and industry-leading experts for a series of live webcasts. Gain the insight to ensure you are prepared for what’s to come.