Multifamily Sales to Pick Up Mid-2024

One reason is loan maturities, which will create transaction opportunities.

The predictions about commercial real estate’s recovery have not been pretty. CBRE, Cushman & Wakefield, and JLL all believe that any improvements will not become apparent until the second half of next year. Worse, CBRE anticipates that there will be a 5% drop in transactions next year due to rising Treasury yields that are making the cost of borrowing even more prohibitive. Meanwhile, BlackRock is forecasting that borrowing rates will remain at levels hovering around 5.5% for the foreseeable future.

But multifamily may escape this doom and gloom. Always the industry’s golden child, multifamily transactions are expected to pick up in mid-2024, according to Kelli Carhart, leader of multifamily capital markets for CBRE. These deals will be driven by an end to the Fed’s rate-hiking cycle and improved capital markets conditions, as well as loan maturities that will create transaction opportunities, she says.

We may be beginning to see signs of a gradual increase in transactions in this category. Deal volume decreased by 8.5% quarter over quarter in Q3, but that was 6% more than in Q1. Also, apartments accounted for the largest share of investment (34%) in Q3, which equaled Q2.

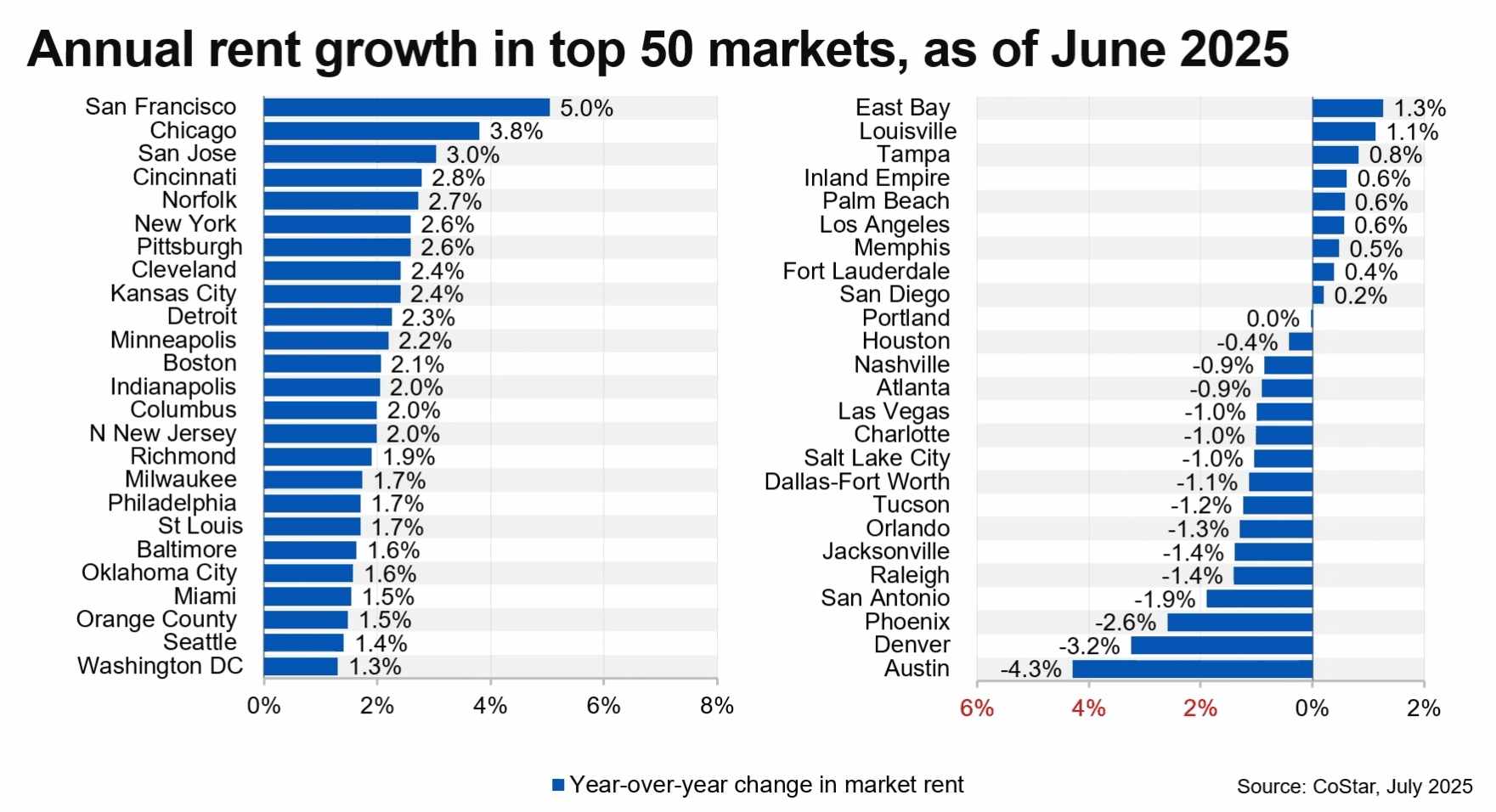

Still. Deal flow is down 38% from the average share between 2020 and 2022, and market-specific data for some locales reflects that.

For example, gateway cities such as New York, Boston, Washington, DC, Chicago, Los Angeles, and San Francisco tumbled 13% quarter-over-quarter. Meanwhile, Atlanta, Raleigh-Durham, Phoenix, and Dallas had the biggest quarterly gains.

Dallas-Fort Worth led all markets in investment volume over the past four quarters, accounting for 71% of the US total.

Source: Multifamily Sales to Pick Up Mid-2024

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.