Chicago multifamily rents accelerated in January 2026, placing the market among the strongest performers nationally. While U.S. average apartment rents increased modestly to $1,713 (+0.2% month-over-month), Chicago posted 3.2% annual rent growth, reinforcing Midwest outperformance as Sun Belt markets continue to absorb elevated new supply.

Nationally, rent growth remains subdued compared to prior peak-cycle levels. However, seasonal momentum appears to be returning as 2026 begins, suggesting gradual normalization rather than continued deterioration.

For Chicago investors, the takeaway is clear: fundamentals remain comparatively stable, but underwriting discipline is critical.

National Rent Trends: Gradual Stabilization

Across the U.S., rents edged higher in January following a muted second half of 2025. Year-over-year national rent growth measured 0.6%, down from 1.5% one year earlier.

Regional performance showed broad-based monthly increases:

-

Midwest: +0.27% (strongest region)

-

Northeast: +0.21%

-

South: +0.17%

-

West: +0.09%

On an annual basis, the Midwest led with 2.1% growth, followed by the Northeast at 1.4%. In contrast, the South declined 0.2% and the West fell 1.5% year-over-year due to continued supply pressure in high-growth markets.

This divergence reinforces a key theme entering 2026: markets with disciplined supply pipelines are outperforming those that experienced aggressive development cycles.

Chicago Performance: Outpacing Supply-Heavy Markets

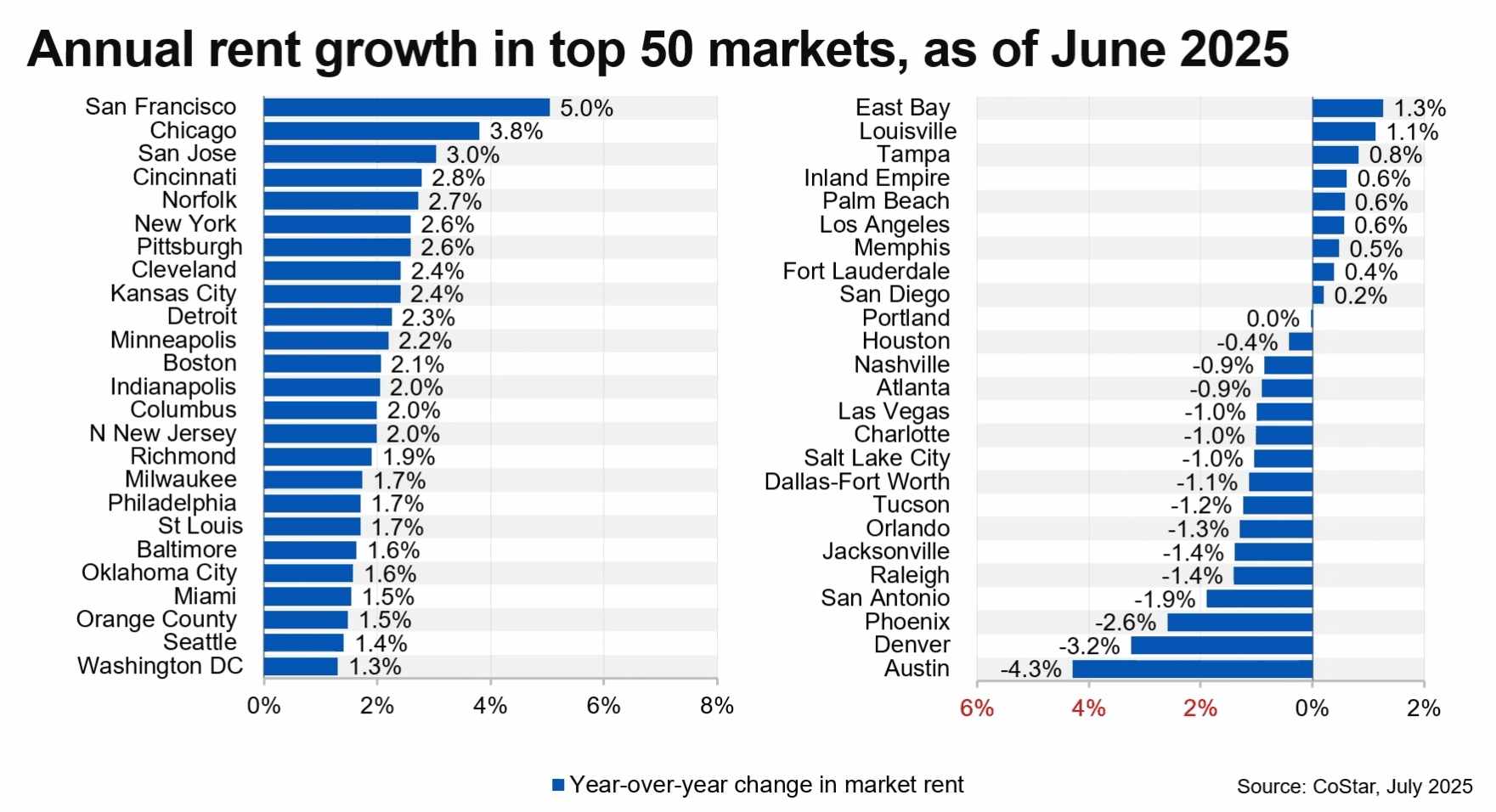

Among major U.S. metros, Chicago ranked near the top tier for annual rent growth at 3.2%, outperforming many Sun Belt and Mountain West markets where rent declines persist.

By comparison:

-

San Francisco: +6.3%

-

Norfolk: +4.3%

-

San Jose: +3.5%

-

Chicago: +3.2%

Meanwhile:

-

Austin: –4.8%

-

Denver: –3.3%

-

Phoenix: –3.3%

The contrast is structural. Chicago’s development cycle has remained comparatively measured relative to markets such as Austin and Phoenix, where supply growth outpaced demand during the prior expansion.

Midwest markets continue benefiting from:

-

More balanced construction pipelines

-

Durable employment bases

-

Lower volatility in absorption cycles

Supply Overhang: Still Present, Gradually Easing

While many U.S. apartment markets have moved beyond peak delivery levels, a meaningful inventory overhang remains in supply-heavy metros. Elevated vacancy in those markets continues to suppress rent growth.

Chicago’s pipeline, while active, does not reflect the same degree of imbalance. As a result, rent moderation has been limited compared to high-growth Sun Belt metros.

The January data suggest seasonal rent patterns are reasserting themselves, signaling stabilization rather than renewed contraction.

What This Means for Chicago Multifamily Investors

1. Underwrite Conservatively

Rent growth is stabilizing, not accelerating. Underwrite 2–3% annual growth assumptions, not peak-cycle projections.

2. Cap Rate Sensitivity Still Dominates

A 25–50 basis point cap rate shift can offset multiple years of rent growth. Valuation discipline remains paramount.

3. Midwest Relative Strength Matters

Institutional capital seeking stability may continue reallocating toward Midwest core markets as Sun Belt volatility persists.

4. 1031 Exchange Timing Is Critical

With pricing no longer expanding rapidly, execution speed and realistic underwriting assumptions are essential for successful exchanges.

Strategic Positioning in 2026

Chicago multifamily fundamentals remain comparatively resilient entering 2026. Rent growth is positive, supply pressures are manageable, and seasonal patterns are normalizing.

However, the investment environment is no longer forgiving.

Disciplined underwriting, careful debt structuring, and realistic exit assumptions will separate successful acquisitions from marginal ones.

For owners evaluating disposition or recapitalization strategies, understanding the interplay between rent growth, cap rates, and buyer underwriting standards is critical in today’s market.

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.