Voracious appetite for net-lease product has propped up values, but if inflation continues to push the 10-Year Treasury up, cap rates will follow.

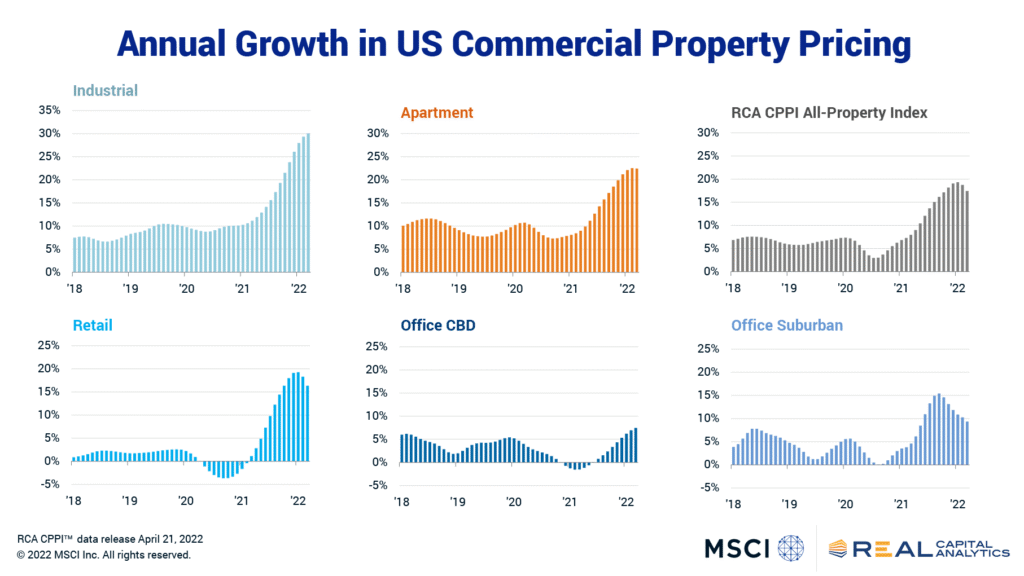

The headline rate of U.S. commercial real estate price growth eased from all-time highs in March. The RCA CPPI National All-Property Index increased 17.4% from a year ago, down from the record 19.3% rate seen at the start of 2022

As a landlord or property manager, you can and should require a tenant to buy and maintain renters insurance in the lease. Although renters insurance isn’t necessarily required (depending upon your state laws), it’s a good idea to make it a requirement to rent your property.

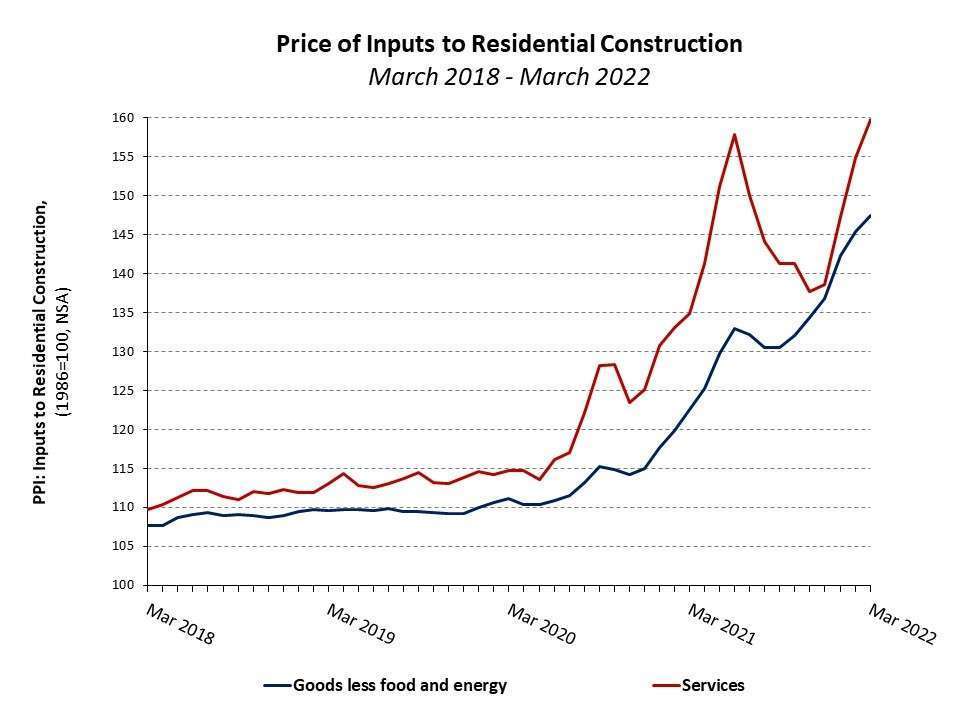

Building material prices for home building and remodeling are up 20% year-over-year and 33% higher since the pandemic began. This will be a lagging contributor to higher rents, home prices, and inflation given ongoing affordability challenges.

The go-to financing choices of CRE investors and developers are shifting as rising interest rates chase inflation amid clouds of uncertainty.

Think cap rates are crazy low? They could drop even more as investors battle to own CRE income streams, according to a new analysis from First American Financial Corporation. But the firm says cap rates may be reaching a cyclical bottom.