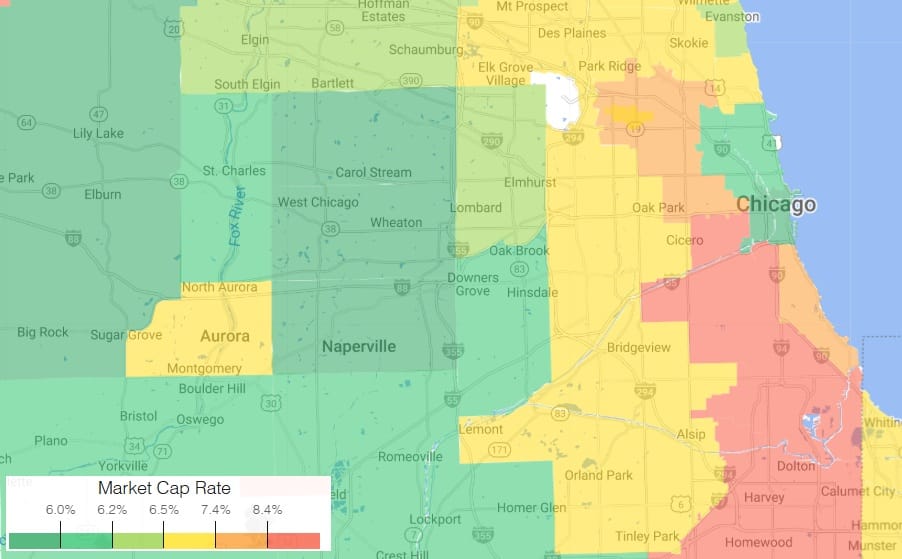

The Southeast DuPage County multifamily market Q4 2025 posts 6.8 % vacancy and 2.3 % rent growth. Review cap rates, pipeline, and 2026 investment outlook.

Chicago Multifamily Insights

Strategic Intelligence for Apartment Owners & Investors

Market Reports

Chicago multifamily market data across city and suburban submarkets. Rent trends, sales velocity, cap rate direction, and investment fundamentals—updated regularly.

The North DuPage County multifamily market Q4 2025 posts 5.2% vacancy and 2.7% rent growth. Explore cap rates, pipeline, and 2026 investment trends.

The Naperville Lisle multifamily market Q4 2025 posts 5.6 % vacancy and 3.4 % rent growth. Explore rent trends, cap rates, and investor outlook for 2026.

The Aurora multifamily market Q4 2025 features 3.1% vacancy, 1.9% rent growth, and strong investor demand. View 2026 rent, cap rate, and development outlook.

Chicago multifamily market 2025 Q4 shows 3.5 % rent growth, 4.7 % vacancy, and steady buyer demand. Chicago multifamily broker insights on cap rates, valuations, and investment strategy for 2026.

Discover the latest rents, vacancy rates, and investment opportunities in Kane County's multifamily market for Q3 2024. Stay ahead with actionable insights.

Aurora Naperville multifamily market Q3 2024 report: rent trends, vacancy rates, and investments. Download the full report now!

Explore key trends in Chicago's rental market from our January 2024 Rent Report. See how median rents are shifting.

Market Trends & Insights

Forward-looking analysis on rates, capital markets, sentiment, and policy shifts impacting property values and transaction timing.

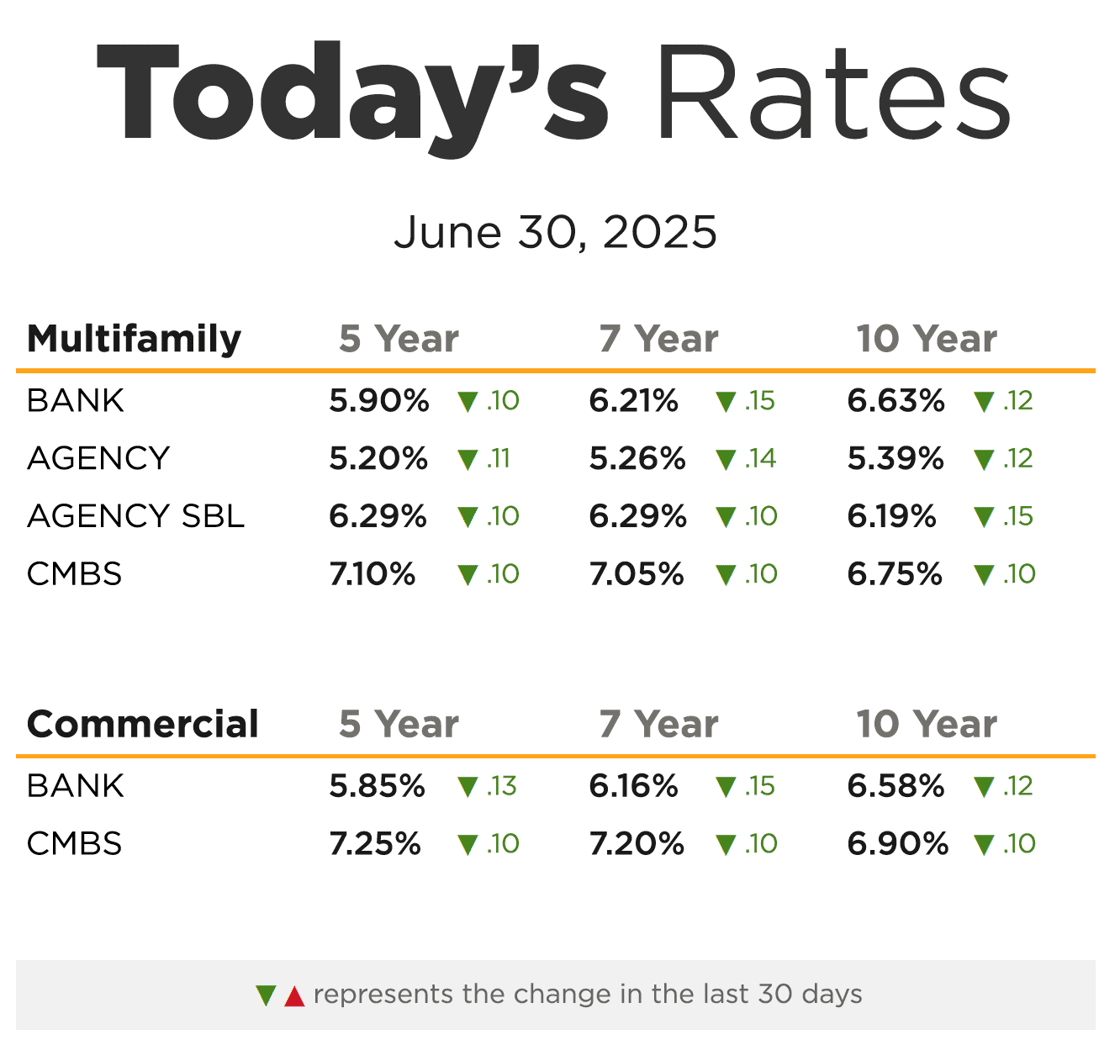

Chicago multifamily mortgage rates stabilize in February 2026. Updated Agency, Bank, CMBS, and SBL rates for apartment owners and investors.

In 2025, national rent growth cooled, while Chicago saw a decline in apartment rents. Investors should adjust strategies with careful underwriting, focus on stable assets, and consider the higher cap rates in Chicago for future planning.

Explore October 2025 Chicago multifamily mortgage rates. See the latest Bank, Agency, and CMBS trends, rate shifts, and investor implications for the Chicago multifamily market.

Chicago apartment market 2025 sees historic supply lows, rising rents, and fierce investor interest. Find out what this means for the city’s future.

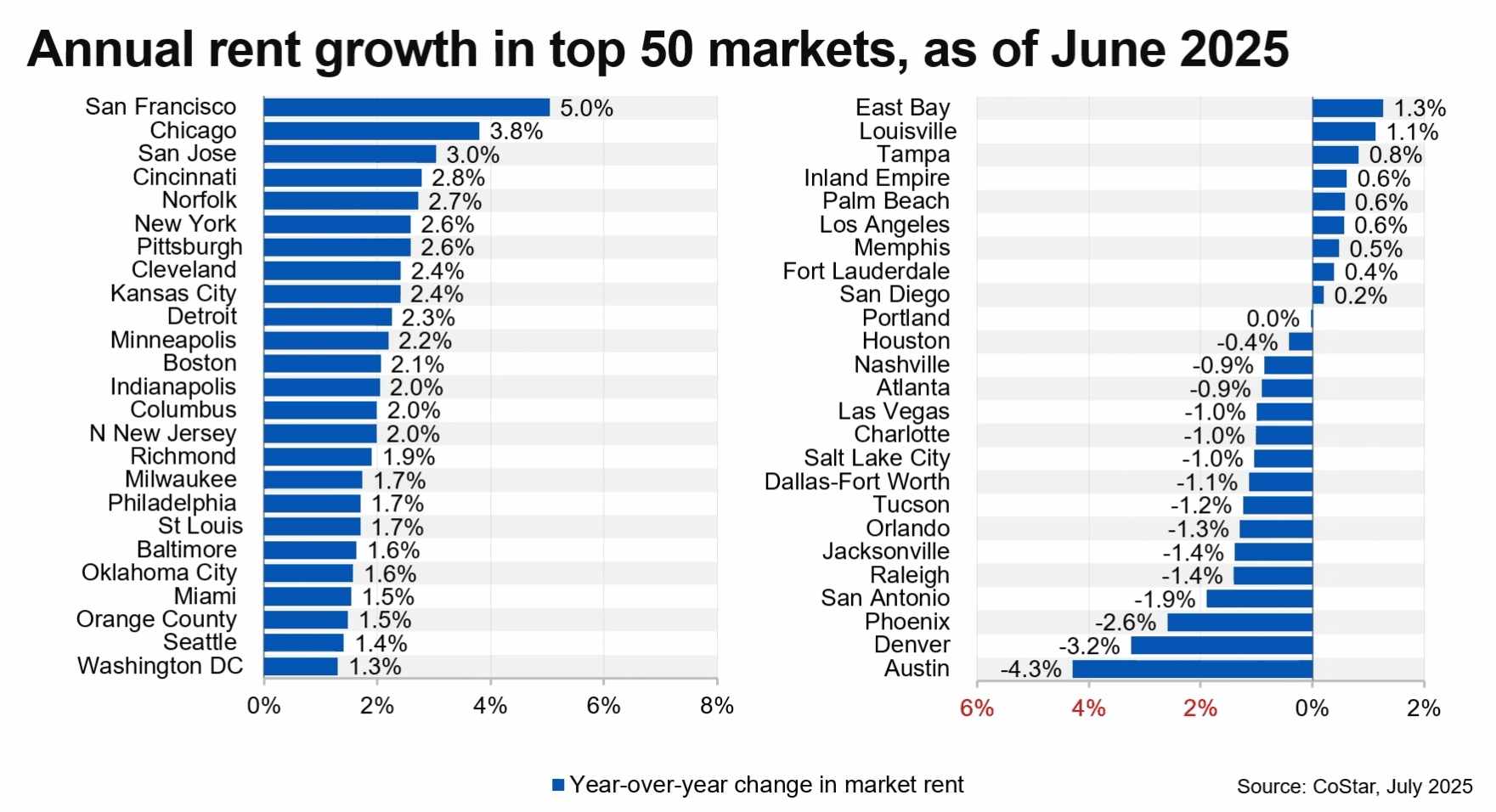

Chicago rent growth hits 3.8% in 2025, ranking second in the U.S. as supply tightens. Sun Belt cities struggle amid oversupply.

Review Chicago multifamily mortgage rates for June 2025. Compare bank, agency, and CMBS loan terms to guide your investment strategy

The Chicago multifamily market in 2025 shows 3.8% rent growth, 4.7% vacancy, and strong investor activity. Explore Aurora trends too.

Multifamily market update: Join NMHC's July 21 webinar for key insights into sales, financing, and tightness trends.

Discover 2025 trends in the commercial real estate market: industrial growth, suburban office gains, and retail & multifamily resilience.

Chicago rental market 2025 heating up—rents climbing, demand surging, and tight supply shaping the future.

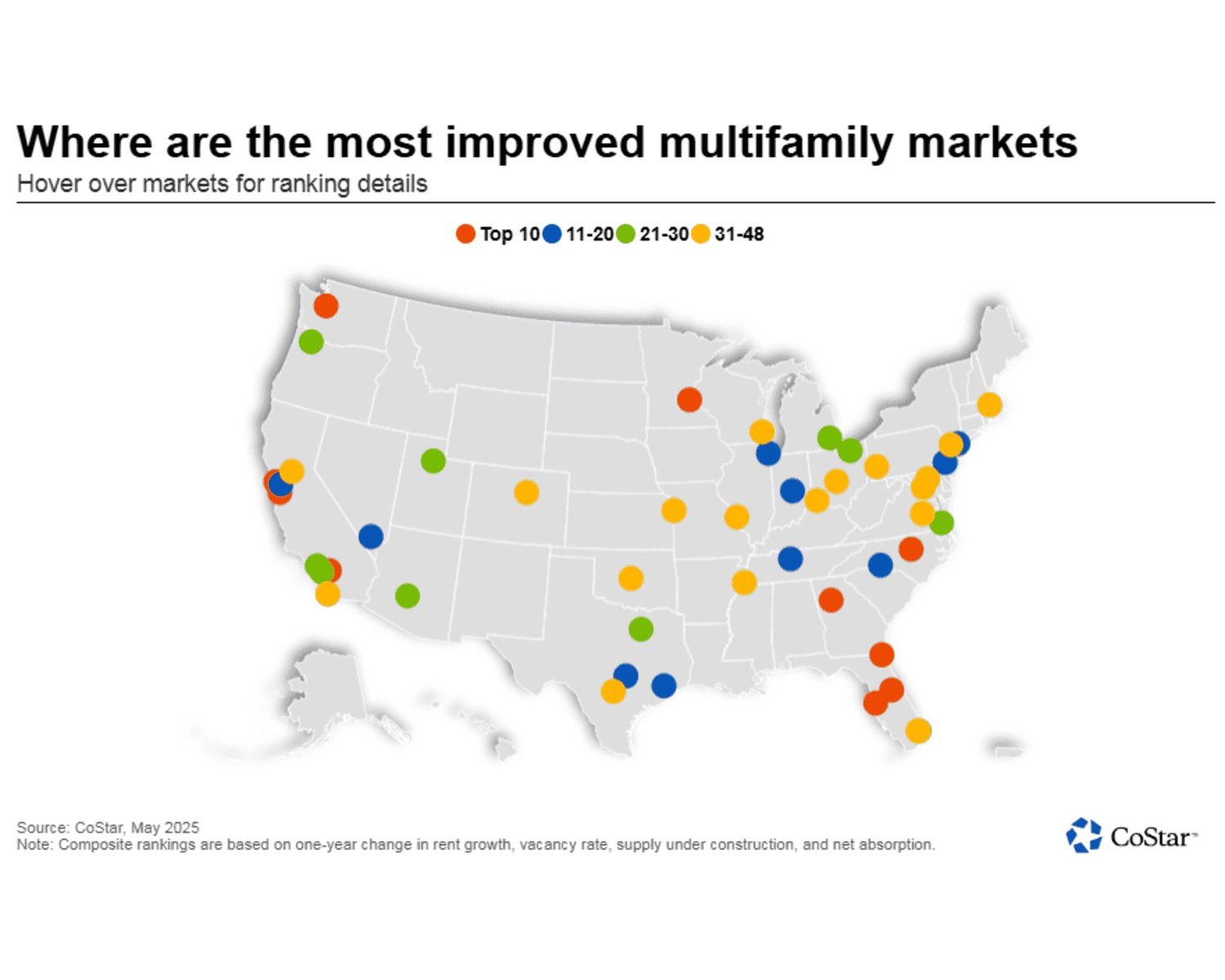

Discover how the U.S. apartment market rebound is playing out in 2025. The Midwest is driving dynamic new rental trends.

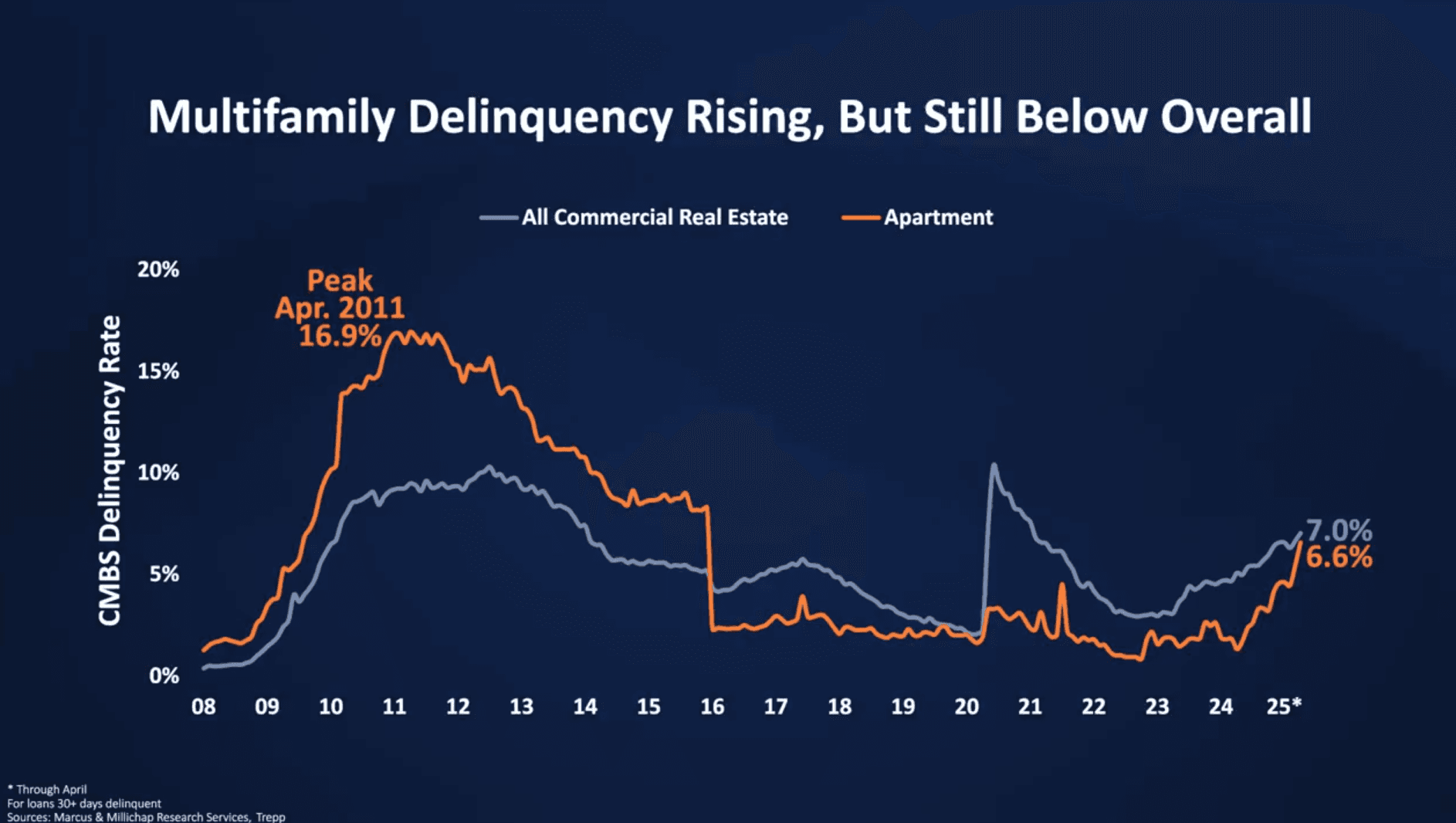

Explore commercial real estate distress 2025 trends and where investors are seeing the most risk by sector.

The Chicago multifamily market 2025 shows strong demand, driven by favorable demographics, affordability gaps, and low vacancy rates.

Discover expert-led Chicago multifamily market insights from the NMHC Q2 2025 webinar, including leasing trends, financing, and economic forecasts.

The 2025 Multifamily Market Outlook explores CMBS & CRE CLO trends, rental market shifts, and financing insights for apartment investors.

The Chicago Multifamily Podcast helps property owners maximize NOI, boost value, and navigate Chicago’s market.

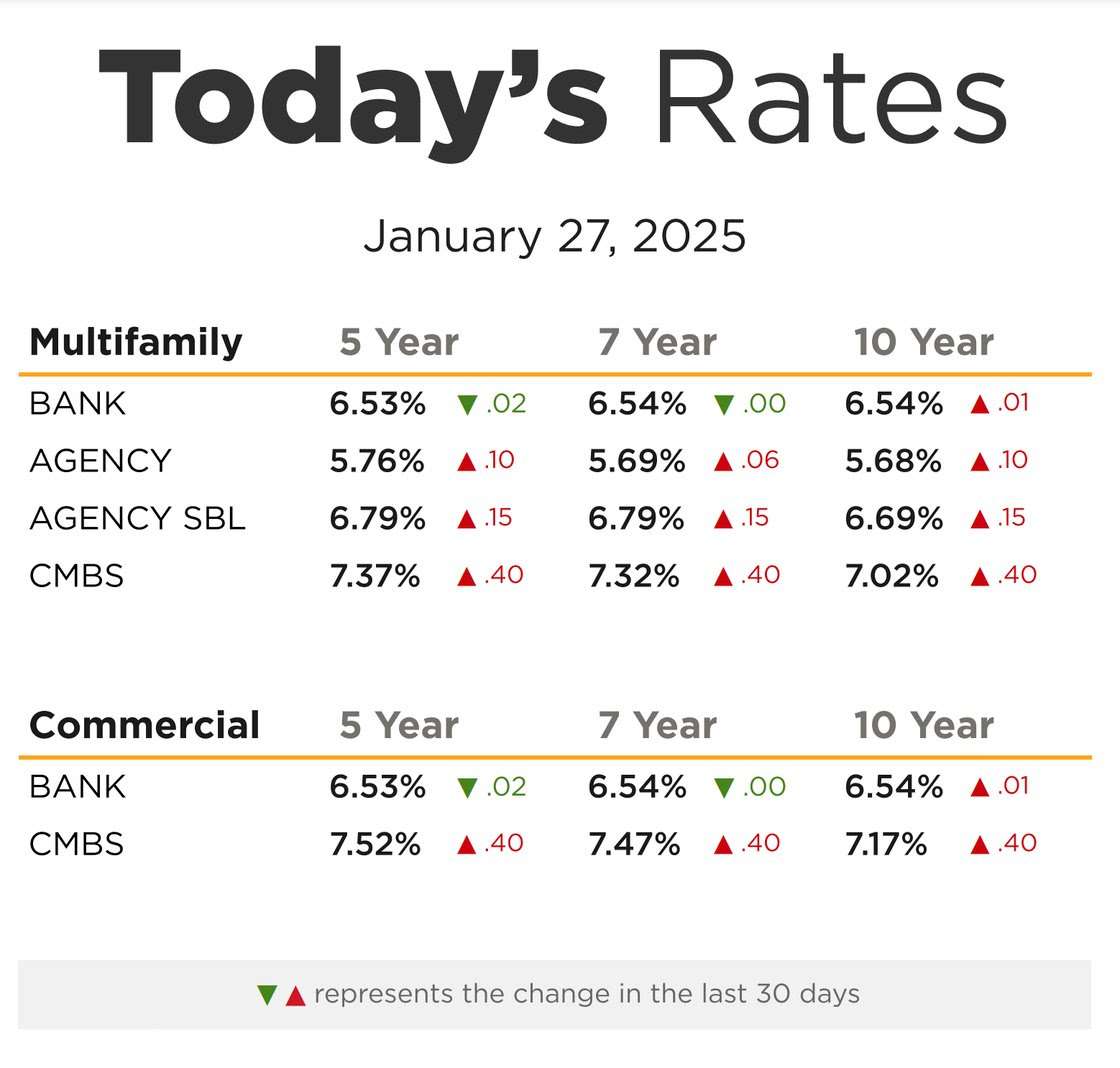

Discover January 2025 Chicago multifamily mortgage rates, trends, and insights to optimize your investment strategy in today’s market.

Explore multifamily investments in Chicago for 2025. Learn about rising rents, stable interest rates, and market strategies for success.

Explore trends in the Chicago multfamily market, including rents, vacancy rates, and investment projections for 2025.

Trump’s economic policies, including tariffs and immigration, impact multifamily property investments in Chicago. Learn how to adapt.

The multifamily market is poised for a shift in 2025 with declining new supplies and potential rent growth, particularly favoring mid-priced properties while luxury segments grapple with overexposure.

Explore the latest multifamily mortgage rates with insights from top Chicago multifamily experts and learn how a Chicago multifamily investment broker can help maximize your property’s value.

In a world where economic factors can swing like a pendulum, understanding the commercial real...

1150McConnell Road is a prime 73,245 sq ft industrial facility in Woodstock, IL, featuring modern office space, extensive loading capabilities, and excellent access to major highways, making it perfect for various industrial operations.

Explore October 2024 multifamily mortgage rates in Chicago and how they impact property sales and listing strategies for investors.

1150 McConnell Rd industrial property in Woodstock, IL. Reduced to $3,950,000. Ideal for manufacturing and investment.

Staying informed on multifamily mortgage rates is essential for real estate investors. As of September 2024, rates have notably adjusted: Bank Rates for 5-year terms decreased to 6.80%, Agency Rates fell to 5.12%, Agency SBL Rates rose to 5.89%, and CMBS Rates dropped to 6.62%. These changes may impact financing strategies.

Explore key trends in the Q2 2024 Chicago multifamily market, including rent growth, vacancy rates, and investment activity. Essential insights for property owners.

Renewed vigor in multifamily real estate as transaction volumes rise, fueled by financing opportunities and institutional investments.

Chicago's multifamily market booms with rising rents & low vacancies. Learn how to profit as a multifamily property owner.

Discover multifamily market stabilization trends, including rising demand, stable vacancy rates, and rent growth potential in 2024.

Demand for multifamily units is booming with record absorption rates in 2Q2024, Cushman & Wakefield reports.

U.S. multifamily market reports 1% rent growth as supply-demand gap narrows, Midwest and Northeast outperform

While multifamily operators face cost increases, consistent demand keeps absorption healthy in most markets. Learn why selling your property now might be a smart move.

Discover why college town apartment markets are more stable and resilient than national trends.

FOR SALE: FULLY OCCUPIED 24-UNIT

DeKalb, IL, Northern Illinois University:

https://creconsult.net/dekalb-il-multifamily-property-sale-924-greenbrier/

New data shows a sharp rise in build-to-rent single-family home construction, addressing housing affordability and investment diversification.

Development Land For Sale:

77 Acres Golf Course Community

https://creconsult.net/fairway-lakes-estates-development-opportunity/

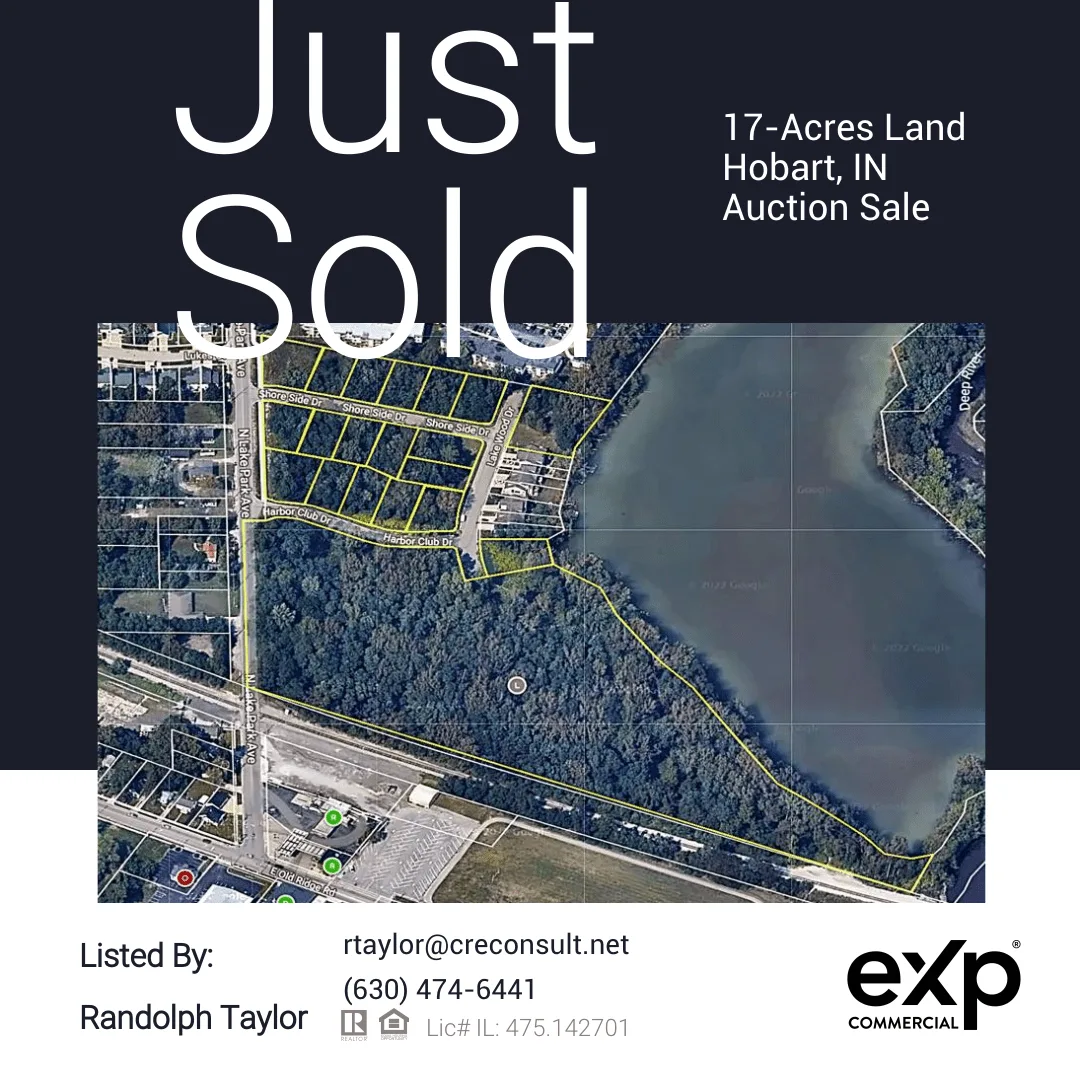

17 Acres Lakefront Community:

https://creconsult.net/prime-development-opportunity-northwest-hobart-in/

Despite a 20% rise in apartment demand in Q1 2024, heavy supply restricts rent growth and occupancy across the US

Persistent high interest rates reshape commercial property strategies, impacting owners and lenders alike amid market shifts.

Discover the early 2024 signs of stabilization in the multifamily market. Explore key trends, supply and demand insights, and expert predictions.

Explore the multifamily investment outlook for 2024 as experts weigh in on the potential impact of lower interest rates, slowing rent growth, and the lingering effects of 2023's slowdown.

Explore the latest insights on the U.S. economy's robust growth, inflation trends, and the impact on mortgage rates and housing market in 2024.

NAR's $418M settlement reshapes real estate commissions, affecting residential and commercial sectors differently.

Explore the 2024 split in the US rental market: luxury rents fall as average rents continue to rise, affecting renters nationwide.

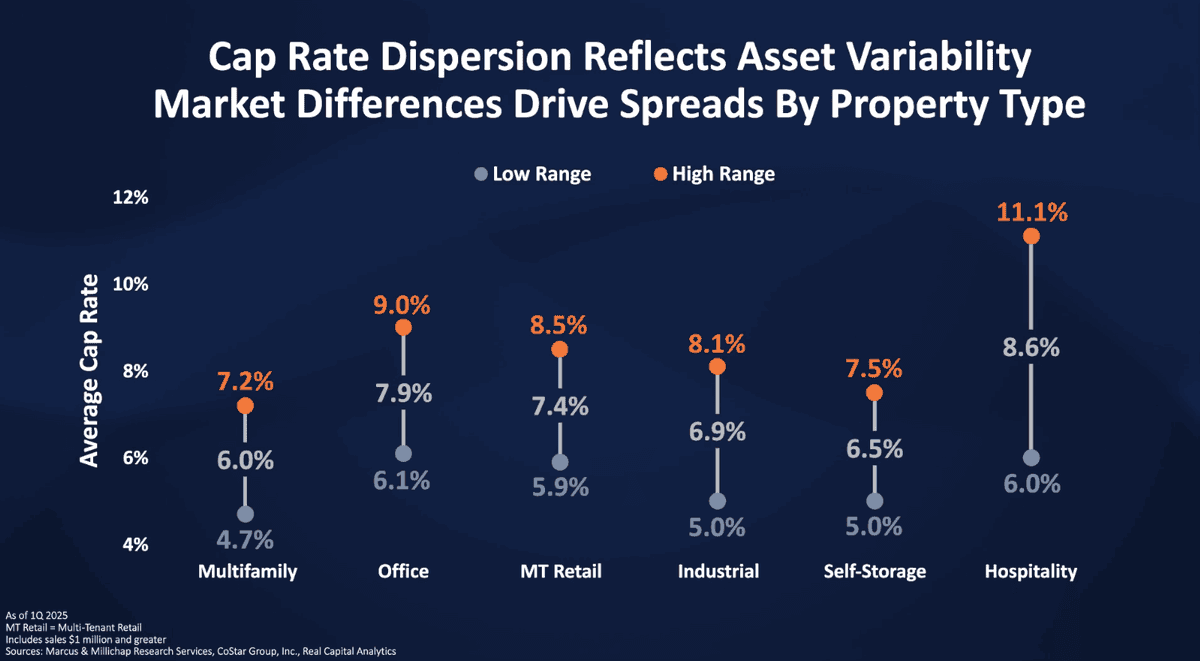

CBRE's H2 2023 Cap Rate Survey for the latest on real estate investment trends, cap rates, and market expectations.

CRE investment insights for 2024 amidst economic shifts. Discover key strategies and the enduring value of relationships in real estate.

Discover insights from 40 CRE execs on 2024 strategies and preparations across diverse sectors and cities. Real estate outlook and trends.

Explore the compounding impact of organic rent growth on multifamily underwriting and how realistic assumptions can drive successful investments.

2024 multifamily market trends, focusing on the balance between demand and supply, and the impact on rent growth and vacancy rates.

Explore the 2024 outlook on multifamily rent trends, market challenges, and investment impacts. See what's ahead for the sector.

Explore the 2024 multifamily forecast: key trends, growth challenges, and investment insights. Stay ahead in real estate with Freddie Mac’s analysis.

Discover the resilience and potential of suburban multifamily properties in Chicago. Ideal insights for investors seeking stable market opportunities.

Attend Moody's Analytics CRE webinar on Feb 29 for pivotal economic data and insights relevant to Chicago's multifamily market.

eXp Commercial integrates Moody's Analytics CRE to provide advisors with data-driven insights, analytics, and research, enhancing decision-making and market trend anticipation in commercial real estate.

Discover 2024's multifamily market trends in Aurora/Naperville and how they can guide your investment strategy.

Discover Chicago's leading role in office-to-apartment conversions, with a deep dive into the city's market trends and significant projects from RentCafe's report

eXp Commercial is launching specialty committees in various fields of commercial real estate to provide targeted support to its agent advisors. These groups cover sectors such as multifamily, office, industrial, and retail to allow for industry-specific networking, business growth, and shared insights to better serve our clients.

Renters everywhere are looking for more balance in their lives and in their homes. And renters in the Midwest are no exception, according to findings from the 2023 NMHC and Grace Hill Renter Preferences Survey Report, a national report that includes responses from renters in 11 major Midwest markets.

In 2023, U.S. multifamily and industrial sectors shifted, with decreased demand impacting absorption and vacancy rates, while office space hit record high vacancies amidst evolving work models. Retail faced stagnation; yet, overall CRE markets suggested opportunities amidst economic rebalancing.

Even as sales improve, rate cuts won’t paper over all of the issues that emerged during the past two years, leaving some types of properties primed for sales. Here are four things buyers and sellers can look for in the coming year.

The January 2024 Rent Report uncovers the latest in rent growth, market shifts, and vacancy rates. Discover essential market insights today!

The 2024 multifamily market is generating optimism, with the Federal Housing Finance Agency (FHFA), Federal Reserve, and Freddie Mac indicating a potential increase in transaction volume after a sluggish 2023.

The United States faces a significant housing shortage, with a deficit of approximately 3.2 million homes. This shortfall, which represents about 2.5% of the total U.S. housing inventory as of 2022, is a major contributing factor to the sustained high prices in the housing market.

2023 was a challenging year for real estate, with widespread declines in asset values and reduced transaction volumes. Looking ahead, investors are hopeful for stabilized prices and a return to normal market activity. Here are five key trends to watch

Consumer confidence is closely linked to apartment demand. When consumers are optimistic about the economy, apartment demand increases, as seen in recent trends.

Navigating the complexities of commercial property taxes can be a daunting task for even the most seasoned investor. Overvalued assessments, opaque regulations, and ever-changing deadlines can quickly drain your bottom line and hinder your property's potential

Thanks to sky-high interest rates, an uncertain economic climate, changing priorities, and ongoing hybrid- and remote-work policies, consumer sentiment towards home ownership is at an all-time low.

Housing prices and interest rates are making owning a single-family home more expensive than ever. And many consumers are choosing to avoid these costs by renting instead of buying.

In 2023, the Midwest emerged as the most competitive rental market in the U.S., with three cities in the top five, driven by its affordability, ample space for remote work, and easy access to nature.

As the real estate market adjusts to new norms in a post-pandemic world, the commercial and investment property sectors are shifting.

Despite concerns about uncertainties and a potential recession, the 2024 forecast for the rental market shows robust fundamentals for multifamily.

Distress in the commercial real estate market has bottomed out, and conditions will soon be on the upswing as more investors from the private equity world seize opportunities to jump into the space

Commercial real estate remains a highly favored investment class, and multifamily stands above the rest.

As rising real estate prices have been reshaping homeownership across the country, the commercial landscape has also been going through a drastic shift

The Northeast and Midwest regions led gains, with New York City (6.2 percent year-over-year), Kansas City (4.0 percent), New Jersey (4.0 percent), Columbus (3.4 percent) and Chicago (3.2 percent) posting the highest advances.

Single-family permits that start in October 2023 were 13% higher in the U.S. than the prior year From September to October this year, multifamily starts and multifamily permitting rose in the U.S. as a whole.

More than 80% of panelists believe interest-rate cuts will begin in 2024, with most expecting cuts to start in the second or third quarter of 2024.

In 2023, the U.S. multifamily market has seen a significant upswing in renter demand, especially for mid-priced apartments rated three stars. This shift marks a recovery from a sluggish performance in the latter half of 2022.

For renters who've felt the sting of rapidly increasing costs, there's a sigh of relief on the horizon. The rapid inflation of rent prices, which has been a pressing concern for many in recent years, is showing signs of stabilization.

Investors are flocking to student housing as its rent growth outpaces traditional multifamily properties, lured by its resilience during economic downturns and higher-than-average returns.

More than half of the country's 100 largest cities report decreasing rents. Significant drops are seen in "zoom towns" like Arizona, Nevada, Idaho, with Oakland, California, noting an 8.7% decline. Meanwhile, Midwest and New England cities, such as Chicago and Boston, show modest recent rent growth compared to prior years.

For years, renting in the suburbs meant shelling out less than city rents. However, recent data indicates that this traditional disparity is lessening, leading many to wonder why.

A rising number of the super-rich are placing their bets on the US rental market as falling prices in the apartment sector make it increasingly attractive.

This year sees a marked decline in new apartment construction, attributed to elevated interest rates, reduced rents, and overbuilding worries in select regions.

The multifamily sector faces a complex supply challenge, with abundant ongoing development and varied implications across different locations and property types.

National supply-demand imbalances in multifamily housing affect pricing, leading to varied rent changes in different metro areas over the year.

With strong fundamentals, new construction starts, and a sizable amount of capital on the sidelines, the multifamily sector is attracting the attention of eager investors.

The multifamily sector deviates from these patterns. Due to its short lease structures, this sector is more responsive to economic changes. In the last downturn, transaction volume slowdown and price declines in multifamily occurred simultaneously, with prices stabilizing much faster than in other sectors.

As 2024 nears, the rental housing market grapples with challenges and opportunities in a fluctuating economic landscape, shaped by inflation and rising costs. Here are 5 key trends expected to influence the sector in the coming year.

Multifamily real estate can benefit first-time and experienced commercial real estate investors. Scaling up a real estate portfolio is much simpler with multifamily buildings thanks to their multiple units or “doors.”

Commercial property rates are expected to stabilize – aside from office space – and commercial real estate will revitalize, according to NAR Chief Economist Lawrence Yun.

Always the industry’s golden child, multifamily transactions are expected to pick up in mid-2024,

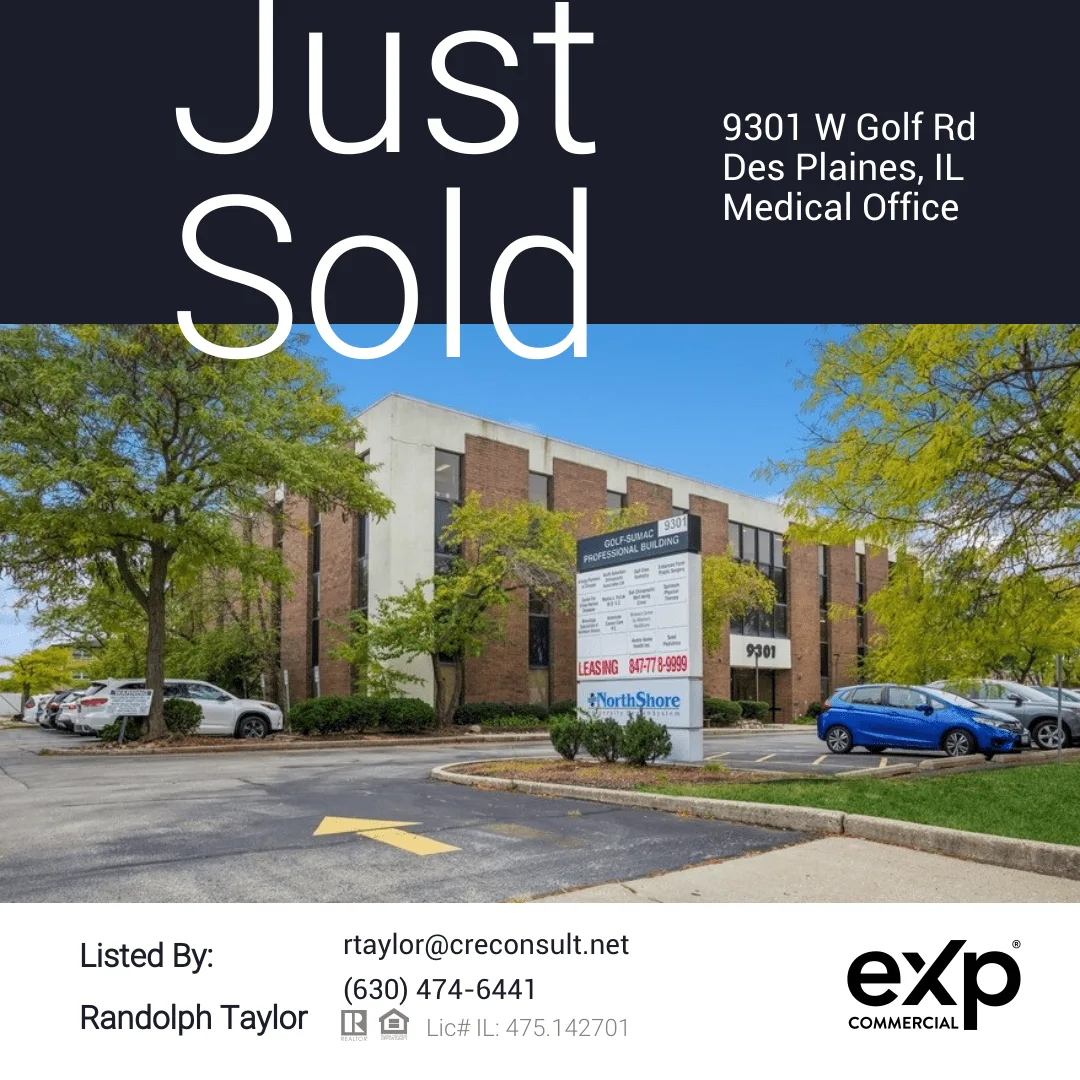

Medical offices were not as affected by the pandemic as other facets of the health care system." As a result, vacancy rates have remained steady

Although rent growth has cooled significantly over the past year, the national median rent is still 23 percent higher than it was just three years ago, and in some markets, the increase has been even more substantial.

In the five-year span from 2015 through 2019, the big lenders for multifamily were government-sponsored enterprises. In the first half of 2023, the same dynamic is again present

While few economists expect a housing crash in the near future, many do think the market will cool off because current mortgage rates are making buying a home even less affordable.

Floating rate CRE loans are a challenge when interest rates are rising, which makes sense. Unless an investor, developer, owner, or operator has planned ahead, the increasing rate tide means there is a good chance that whatever floating rate a plan has anticipated won’t be enough.

For the first time in more than 20 years, Chicago’s apartment rent growth is the highest among its major market peers over the course of three consecutive quarters.

With less that 5% of the rentals here available and little to no apartments built recently, 67.3% of apartment dwellers in the area decided to just stay put.

eXp Commercial is pleased to present to market Indian Creek Apartments, a fully occupied 24-unit multifamily complex on the northeast side of Aurora, Illinois, bordering affluent Naperville, Illinois, just to the east. The property is in good condition, with considerable upside in rents with modest unit updates. All units have separately metered tenant-paid water, sewer, electricity, heat, and hot water. Also offered is an attractive low-interest assumable debt of $1.453 million at a 3.32 percent interest rate not due until December 2028.

In Chicago, there is a great inventory of multifamily properties. But we still have not been able to keep up with rental demand. The higher interest rates have kept some people from buying single-family homes.

Seller Guidance

Strategic guidance for Chicago apartment owners evaluating a sale, preparing assets for market, and maximizing disposition proceeds.

Explore Chicago multifamily cap rate trends driven by rent risk, asset class, and location—vital insights for 2025 investors.

Cap rate spreads guide multifamily sellers in timing, pricing, and strategy. Learn what they mean for your Chicago property’s market value and sale.

Modernizing your multifamily property isn’t just good for tenants; it's a smart investment strategy. Learn how to enhance property value through strategic upgrades and request a free valuation analysis today!

This post outlines several operational enhancements that multifamily properties can implement to maximize their Net Operating Income (NOI) including tenant engagement, cost-effective management, and facility upgrades.

Maximize your multifamily property's value with proven optimization strategies for a top market price when selling.

Learn the process of selling your multifamily property with eXp Commercial. Maximize value and create a competitive bidding environment with Randolph Taylor.

Capitalize on the thriving Midwest multifamily market. Cleveland, Cincinnati, Columbus, and Chicago are leading in rent growth. Discover if selling your multifamily asset is a smart move. Contact eXp Commercial for expert guidance.

55,000 U.S. multifamily property loans set to expire by 2028. Will owners refinance or face a sell-off? Insights on the $525 billion impact.

Learn cap rate essentials for multifamily real estate investing to maximize returns and minimize risks. Your guide to smarter investing.

Unlock the potential of your multifamily property with expert Aurora and Naperville apartment building brokers. Get the latest market insights to sell your property effectively.

Navigating the multifamily property sales landscape can be a complex endeavor, requiring careful planning, strategic execution, and expert guidance. To ensure a seamless and profitable sale, thorough preparation is essential. This comprehensive guide outlines the key steps involved in preparing your multifamily property for sale, empowering you to achieve its full market value.

Real estate investors have done well. Rents have risen and home price appreciation has been quite exceptional. In the past three years, the typical rental rate and typical home price have soared by 16.4% and 35.5%, respectively. Over the past five years, those figures are 24.9% and 50.8%. These returns were occurring at a time of low-cost financing.

The broker price opinion (BPO), also known as a broker opinion of value (BOV), is a popular way of estimating the value of a property. Typical reasons for ordering a broker price opinion include estimating value prior to purchase or sale, understanding collateral value when securing a new loan or refinancing, estimating liquidation value, buying out a partner’s interest in a property, among many others. In this article we’ll take a deep dive into the broker price opinion, review the three approaches to market value, and also clear up some common misconceptions about the broker price opinion.

When it’s time to close on a commercial real estate transaction, the process can seem overwhelming. This definitive guide will walk you through every step in the commercial real estate closing process. You will see where the commercial process is similar to the residential process, and where things are different.

A commercial real estate sales contract can be one page or one hundred pages. There are no rules, and every term, every word, is up for negotiation. Nonetheless, there are provisions that are typically included in most CRE purchase agreements, and understanding these provisions is essential for both buyer and seller to protect their interests.

Are you thinking of selling a commercial income property? If so, it is important to calculate the correct tax basis to avoid higher capital gains tax when the property is sold. It is also necessary to determine the tax basis before you sell since the tax basis plays a role in determining depreciation.

If you’re new to the multifamily real estate sector of the commercial market, you may find that it is vastly different from other real estate niches you have previously invested in.

It's important to note that increasing the value of your property takes time and effort, and it's advisable to consult with a real estate professional to determine the best strategy for your specific property and market conditions.

Commercial real estate can be a complex and highly competitive market, and finding the right representation is essential for a successful transaction.

eXp Commercial offers a unique combination of technology, support, and collaboration, making it a better choice for commercial real estate agents who want to take their careers to the next level.

There are a number of reasons to still consider selling your commercial real estate despite high interest rates.

Sophisticated commercial real estate investors always have an exit strategy to help maximize profits by selling when the time is right. There are three main exit strategies to consider when selling commercial real estate:

Selling commercial real estate has always been a complex process due to the multiple steps in the sales process and the uniqueness of each transaction. Despite new transaction trends which have accelerated post-pandemic, the fundamentals of selling commercial real estate remain the same.

You have a great piece of commercial real estate that you’re looking to sell, but you need to know how to find the right buyer. There are many ways to find a commercial real estate buyer.

Unless you have potential buyers lined up, you should contact a commercial real estate broker to help sell your property quickly and correctly. A great commercial real estate broker can provide you with a list of active qualified buyers; tell the broker if you want to sell fast.

A commercial real estate broker works with property owners and tenants to buy, sell, and lease real estate for commercial use. Compared to buying a home, where a lot of emotion is involved, a commercial agent understands that investment real estate is mainly a numbers game.

Marketing a property can increase the sale price by up to 23%, which runs counter to the idea that off-market deals can achieve higher values because a buyer will be more aggressive to seal a trade.

There are a number of reasons why people sell commercial property too late including Complacency, Ownership and Identity, Loss Aversion and Self Reliance Time Traps

Although there is not much an average seller can do to affect the supply line, they can create demand by using a good agent.

Are you thinking of selling your multi-family property?

Here are some of the most frequently asked questions we get from clients looking to sell multifamily properties in Chicago.

The most important benefit of exclusively listing your property with a broker is representation.

It doesn’t really matter what the current real estate market is like if you are looking to replace the investment property with another investment property, the ultimate decision to sell should also be based upon if you can increase your returns with the new replacement property, not what state the current market is in now.

A broker is a licensed professional who you hire to negotiate the sale or purchase of a real estate for a fee or a commission. However, they are typically not attorneys.

As the seller of a multifamily asset, it’s crucial that the buyer you select is the best possible prospect for your property. Don’t waste time, money and opportunities: you must ensure they’re qualified, and can close and execute on the contract as signed.

There are a number of reasons why people decide to sell their multifamily property, but most can be categorized into three groups: Problems, Opportunities, and Changes. With this decision though comes the consideration of capital gains tax and how to ensure you are getting the most for the sale of your property.

Transaction Announcements

Selected listings, closings, and case studies demonstrating market demand and investor activity across Chicago and suburban multifamily assets.

Randolph Taylor, Senior Associate with eXp Commercial’s National Multifamily Division, has...

eXp Commercial brokers $1.475M Wheaton multifamily redevelopment, showcasing suburban adaptive reuse and Chicago investment momentum.

Multifamily property sale Lyons IL by eXp Commercial. Randolph Taylor brokers $1.45M deal showing investor confidence in suburban real estate.

eXp Commercial completes Hobart Indiana auction sale for Chicago client, showcasing national service for multifamily properties

Golf Sumac Medical Offices sale closed for $3.2M by eXp Commercial Chicago. Maximize your property value with our expert services.

eXp Commercial announces sale of fully occupied Indian Creek Apartments in Aurora, IL, a 24-unit multifamily property.

Explore the largest apartment deals of 2023 with our comprehensive market analysis. Dive into key sales, trends, and their impact on the commercial real estate landscape across the US, reflecting on investment shifts and opportunities.

Maximize your sale with eXp Commercial's expertise in Naperville & Aurora multifamily sales. Start with Randolph Taylor for unmatched service.

eXp Commercial, the fastest-growing national commercial real estate brokerage firm, announced the sale of a 12-unit multifamily property located at 557-559 Ashland Ave. in Aurora, IL, for $1,395,000. The property was exclusively listed and sold by Randolph Taylor, CCIM Senior Associate and Commercial Real Estate Broker with the eXp Commercial Chicago office. Randolph can be contacted at [email protected] | (630) 474-6441

Just Sold: 18.504 SF Net Leased Industrial Property Akhan Semiconductor in Gurnee, IL Randolph Taylor, CCIM Senior Associate and Commercial Real Estate Broker with eXp Commercial in Chicago, exclusively listed and brokered the deal. Randolph can be contacted at [email protected] or (630) 474-6441

Just Sold: 23-Unit Multifamily Property in Morrison, IL Randolph Taylor, CCIM Senior Associate and Multifamily Investment Sales Broker with the eXp Commercial Chicago office, brokered the deal and represented both the buyer and seller. Randolph can be contacted at [email protected] or (630) 474-6441

In one of the biggest multifamily real estate deals in Chicago history, New York-based Emerald Empire bought the local portfolio of Pangea Properties in a sale exceeding $600 million.

Brokered by Randolph Taylor CCIM, Multifamily Investment Sales Broker with the Chicago-Naperville eXp Commercial office.

Randolph can be contacted at

(630) 474-6441 [email protected]

Brokered by Randolph Taylor CCIM, Multifamily Investment Sales Broker with the Chicago-Naperville eXp Commercial office.

Randolph can be contacted at:

[email protected]

(630) 474-6441

Brokered by Randolph Taylor, Senior Associate, and a Multifamily Investment Sales Broker with the Chicago-Naperville eXp Commercial office.

Investor Fundamentals

Frameworks and analytical tools for underwriting, 1031 exchanges, return metrics, and multifamily investment strategy.

Sell your multifamily property, defer taxes with a 1031 Exchange, and reinvest in NNN or DST options for steady income.

Unlock the secrets to accurate real estate underwriting with a deep dive into Year 1 assumptions. Learn how to forecast returns with precision.

Join eXp Commercial's webinar on Feb 21 for key 2024 real estate investment strategies and 1031 exchange insights.

Welcome to our comprehensive list of concepts and terms common to the 1031 Tax-Deferred Exchange. This resource is crafted to help professionals, investors, and others understand the terms used as part of a 1031 exchange in real estate.

The CRE industry is navigating challenging waters with higher interest rates, limited financing options, and a slowing economy. Yet, promising developments ("green shoots") suggest potential growth opportunities.

Capital scarcity in multifamily is leading developers and operators to explore alternative funding, with preferred equity gaining popularity due to its higher-than-average returns.

Although some investors prefer finding new construction, there are many benefits to investing in older buildings.

The passage of the Tax Cuts and Jobs Act (TCJA) in 2017 significantly changed the rules for bonus depreciation by allowing businesses to immediately write off 100% of the cost of eligible property acquired and placed in service after September 27, 2017

Fannie Mae has launched a new financing program to support the creation and preservation of workforce housing for middle-income renters.

In this article we are going to conduct an investment analysis on a 140 unit apartment building acquisition. We’ll walk through the process of forecasting cash flows and also explain the calculations needed to determine investment value. Read on as we take a deep dive into the world of apartment investing.

Market leasing assumptions define what happens after a tenant lease expires in a commercial property. Since it’s unknown whether the tenant will renew its lease or not, there are two sets of assumptions. One set of assumptions is used if a new tenant needs to be found. The second set of assumptions is used if an existing tenant renews its lease. Then, there is a renewal probability that creates a weighted average between these two sets of assumptions.

One of the most important ways to use all of the data gathered in a real estate market analysis is to examine the supply and demand factors for a particular type of real estate

The cap rate is an important concept in commercial real estate, and it is widely used. There is often confusion about how to calculate the cap rate using various methods. The purpose of this article is to demonstrate several ways to calculate the cap rate.

One of the most common questions I get is, “How Do I Get A Multifamily Loan?” The simple answer, “Be Prepared!”

If you follow all the rules for a full 1031 exchange and later decide to complete a cash-out refinance on the replacement property, this should not impact your tax deferral.

When tax season approaches, don't forget to look for money-save tax deductions for landlords.

As the Chicago suburbs face record-high office vacancies, the future of suburban office is likely to hinge on the conversion of outdated buildings into modernized mixed-use spaces

Multifamily assets appeal to some investors due to their liquidity — or how fast the property can be sold at market value. Additionally, multifamily properties provide a consistent income stream through tenant rent payments, and the property can often increase in value over time.

Diversifying your investments is always a good idea. And in an economic moment like the present, it's a borderline necessity when the market looks to be approaching a volatile period.

If you’re considering adding commercial real estate to your investment portfolio, look no further – this is the article for you.

Investors use cap rates (short for capitalization rates) to gauge the quality of an investment. But what is a cap rate, how is it used, and how is it calculated?

Utility costs represent a major expense for landlords. This is especially true at multifamily apartment buildings where base rent often includes utility costs. When landlords must incur these costs, the cash flow impacts can be substantial. In this article, we will look at what’s known as RUBS -or a ratio utility billing system. Implementing a RUBS program is a common way owners pass utility costs on to their renters.

As you may know, increasing the Net Operating Income (NOI) of any commercial property will not only increase your cash flow but also increase the value of your property since the value is determined primarily through NOI and Capitalization Rates (quick refresher on how to calculate the value of the commercial property).

Savvy real estate investors are always looking for ways to increase the returns associated with multifamily investors. This is true whether someone has owned the property for decades. Or whether they are looking to acquire an asset and need to justify the purchase price. There are many value-add strategies investors can consider.

By taking a holistic approach and empowering teams with comprehensive solutions that account for asset needs throughout the property life cycle, management companies can establish an operational advantage across their portfolios that will benefit them for years to come.

Whether you’re planning to become a landlord or a real estate flipper or diversify your portfolio, there are important factors to consider before investing in property.

There are no citizenship requirements for buying real estate in the US. Foreigners who are non-citizens can even apply for a mortgage in the US. However, foreign property owners may face complex tax laws compared to US citizens.

For commercial real estate investors, having access to as many metrics as possible to provide insight and comparison opportunities is critical. Various metrics are available, including cash-on-cash return and internal rate of return, enabling investors to compare properties more closely when deciding which to choose for investment.

Estimating the value of real estate is necessary for a variety of endeavors, including financing, sales listing, investment analysis, property insurance, and taxation. But for most people, determining the asking or purchase price of a piece of real property is the most useful application of real estate valuation.

If the current occupants are month-to-month residents, you have more options for changing their lease and tenancy if they meet state and local law requirements.

Real Estate Syndication is the phrase used to describe the concept of pooling the resources of and bringing together several different real estate investors in order to do a large commercial deal.

One of the most fundamental concepts in real estate investing is the capitalization rate, better known as the "cap rate."

Resident retention remains a high priority, and these five incentives can help earn renewals. 5...

1031 Exchanges, Delaware Statutory Trusts, Opportunity Zone Funds, and Other Tax Reduction...

Private real estate is often an attractive investment option for investors seeking tax efficiency....

Loan to value ratio is a standard metric that lenders use to assess default risk and qualify commercial real estate loans. While it’s far from the only data point lenders consider, it’s one of the most basic and often checked early on during the loan application process.

Debt yield hasn’t traditionally been a primary commercial real estate loan underwriting metric, but more lenders are incorporating it into their criteria. In the current real estate market, measuring debt yield ratios provides lenders with a stable assessment regardless of unusual or changing conditions.

Real estate investors need information. The more information they have, the better the decisions they can make. There are a lot of tools to provide this information, but one of the most important is net operating income (NOI). Understanding what this calculation is and how to use it can help investors make decisions quickly regarding any property an investor is considering.

In a cost segregation analysis, your client’s property elements are divided into two categories: real property, which includes permanent and immobile objects, like their building’s foundation, and personal property, which includes objects like a kitchen

Investors who are looking for greater diversification and the potential for a steady stream of income may consider adding multifamily real estate to their portfolios. While many different property types are available to investors, multifamily properties have remained a consistently popular asset class for years.

If you’re a real estate investor, you may wonder how this rising price environment will impact your current holdings and whether you should make some adjustments to your portfolio. Here are a few things to consider before you make your next move.

Want to sell your management-intensive multifamily property but do not want to buy another property or pay capital gains tax? Consider a Delaware Statutory Trust (DST), which is becoming increasingly popular among accredited investors selling property using a 1031 exchange. Investors are not required to provide additional capital for repairs and maintenance as allocated within the budget. Perhaps most importantly, investors have NO responsibility for operating the properties.

There is a backup plan that could save your exchange from taxation. If suitable, the Delaware Statutory Trust or DST is a great option.

If you own an investment property and are thinking of selling it, if suitable, engaging in a 1031 “like-kind” exchange may be a smart move. When done correctly, a 1031 exchange will allow you to defer all or part of the capital gains and depreciation recapture tax you would otherwise need to pay upon completion of your property sale.

When engaging in a traditional 1031 exchange, you must sell your original property before you can purchase a replacement property. The major drawback here is that if the original property takes a long time to sell, you could miss out on your opportunity to buy the perfect replacement property. This is where a reverse 1031 exchange comes in.

The possible tax benefits that the 1031 exchange may offer, in combination with the option to divide assets appropriately to benefit heirs down the line, make 1031 exchanges an estate planning strategy worth considering.

Are you thinking of selling your multifamily property and do not want to pay capital gains tax? DSTs are passive real estate investments run by professionals who manage property acquisitions and day-to-day operations. They often contain relatively low minimums, making them accessible to many real estate investors.

Thinking of selling your multifamily property, but unsure of your tax exposure? The more you understand the ins and outs of capital gains and ordinary income, the better prepared you are to lessen your potential tax hit.

If you’ve been thinking about engaging in a 1031 exchange, a Delaware Statutory Trust (DST) can be an excellent option. However, before getting involved, it’s important to understand the ins and outs of how they work. In particular, “7 Deadly Sins” must be avoided. Otherwise, the DST will fail to meet the “like-kind” requirements established by the IRS.

Even before Covid-19-related hurdles, normal tenant troubles, property maintenance, leasing agents, and property managers make for a headache and a hassle. Direct real estate ownership is not a passive endeavor, and it is not for everyone.

While transitioning from a liquidating DST to a replacement DST is a widely popular approach for investors, this type of transaction still requires the steady hand of an experienced team of professionals to help ensure your reinvestment goes smoothly.

Real estate is supposed to be a great inflation hedge, and it can be, so long as cash flow from rentals can increase fast enough to keep up with cap rate compression.

CRE Industry Fundamentals

Core concepts in multifamily finance, valuation, NOI optimization, and operational best practices for apartment ownership.

Discover the significance of the LTV ratio in commercial real estate, including how to calculate it and its role in financing and property analysis.

This comprehensive guide will provide an in-depth exploration of 1031 exchange rules, shedding light on the intricate details that investors must adhere to for a successful exchange.

There may be slight variations on exactly how each ownership type works in different estates, but below is a general overview of the different ways to hold property

As economic pressures grow, owners and investors increasingly look to professional property management for end-to-end solutions.

The battle between renting and owning is intuitive. If renting is significantly cheaper than owning a home, more of the population will gravitate towards renting. If homeownership is only moderately more costly than renting, people will be more inclined to pursue ownership.

Running a commercial real estate asset on a day-to-day basis can be expensive. As such, it is important for operators to manage costs relative to rental income to ensure that the given property is profitable. From a management standpoint, costs can be grouped into two buckets: Operating Expenses (or “OpEx”) and Capital Expenses (or “CapEx”). While they are both categories of expenses, there are material differences between capital expenses and operating expenses.

Commercial real estate can be broken down into several different categories. At a high level, when people think of different types of commercial real estate, they typically think about shopping centers, office buildings, or warehouses. But the commercial real estate industry is much more precise when it comes to defining property types. Below is a list of different types of commercial real estate with a description of how each category is typically defined.

Valuing commercial property is an important step in every commercial real estate transaction. This post will demystify the commercial property valuation process and walk you through some common valuation techniques used in the commercial real estate industry.

The first task in any real estate investment decision is to build a proforma, which is just a word that means cash flow projection. In this guide, we will define the term proforma, look at an example of a simple real estate proforma, review a more complicated real estate proforma, and also discuss some nuances you may see in the real world.

The capitalization rate is a fundamental concept in the commercial real estate industry. Yet, it is often misunderstood and sometimes incorrectly used. This post will take a deep dive into the concept of the cap rate, and also clear up some common misconceptions.

Understanding Net Operating Income (NOI) is essential in commercial real estate. Without a firm grasp of net operating income, commonly referred to as just “NOI”, it’s impossible to fully understand investment real estate transactions. In this article, we’ll take a closer look at net operating income, discuss the components of NOI, and also clear up some common misconceptions.

Value is traditionally defined as the power of a good to command other goods or services when exchanged. Within this broad definition of value, there are various types of value given to real property, such as investment value, market value, insurable value, assessed value, liquidation value, or replacement value. In this article we’ll go over different types of real estate value, and then zero in and focus on the difference between investment value and market value, which is often confused by commercial real estate professionals.

The internal rate of return (IRR) is a widely used investment performance measure in finance, private equity, and commercial real estate. Yet, it’s also widely misunderstood.

Being completely comfortable with the time value of money is critical when working in the field of finance and commercial real estate. The time value of money is impossible to ignore when dealing with loans, investment analysis, capital budgeting, and many other financial decisions. It’s a fundamental building block that the entire field of finance is built upon. And yet, many finance and commercial real estate professionals still lack a solid working knowledge of time value of money concepts, and they consistently make the same common mistakes. In this article, we take a deep dive into the time value of money, discuss the intuition behind the calculations, and we’ll also clear up several misconceptions along the way.

The topic of replacement reserves is often confusing for commercial real estate professionals. How much should be set aside for replacement reserves? Should replacement reserves be included in net operating income? How do replacement reserves impact cap rates and value? In this article, we’re going to take a closer look at reserves for replacement, clear up the confusion, and also tackle some common misconceptions.

In commercial real estate the tenant estoppel often comes up during the due diligence phase of an acquisition or during the underwriting of a loan. What exactly is a tenant estoppel and how does it work? Let’s dive in and take a closer look at the tenant estoppel.

The Debt Service Coverage Ratio, often abbreviated as “DSCR”, is an important concept in real estate finance and commercial lending. It’s critical when underwriting commercial real estate and business loans as well as tenant financials, and it is a key part in determining the maximum loan amount. In this article, we’ll take a deep dive into the debt service coverage ratio, explain what a DSCR loan is, and walk through several examples along the way.

The debt yield is becoming an increasingly important ratio in commercial real estate lending. Traditionally, lenders have used the loan to value ratio and the debt service coverage ratio to underwrite a commercial real estate loan. Now, the debt yield is used by some lenders as an additional underwriting ratio. However, since it’s not widely used by all lenders, it’s often misunderstood.

How do you feel about a criminal conviction on your record? Defending against a civil suit for intentional infliction of emotional damage? They don’t sound too bad? Well, how about a fistfight with a tenant on the front lawn of your rental property? If you’d prefer to avoid these scenarios, it might be a good idea to understand the process required to lawfully evict a tenant. While the details of the eviction process vary from state to state, the general principles discussed here are almost universal.

What is a tenancy in common (TIC)? What are its characteristics? Its advantages and disadvantages?

Created to help low-income, elderly, and disabled households afford decent, safe and sanitary private housing, the Housing Choice Voucher Program (HCVP), commonly known as Section 8, provides a federally-funded subsidy to eligible families, paying for all or a portion of their rent and utilities costs. The Program provides not only significant benefits to these families, but also an opportunity for those landlords who chose to participate to potentially make their property more profitable.

To a developer, affordable housing means lower rents than a market-rate project, lower net operating income, and thus lower returns on their investment. Accordingly, without any outside incentive a developer has little motivation to build affordable housing. Unfortunately, the need for affordable housing is significant.

Many real estate investors fail to recognize the importance of the market analysis. Whether they lack the skills and knowledge to complete the market analysis or just don’t understand the benefits, market analysis is an undervalued asset in real estate investment.

A detailed market analysis is key to any real estate investment decision. Even though the financial projections have far more impact in management and investment decisions, market analysis is behind each and every number in the financial statements.

The concept of highest and best use is one of the fundamental principles that underlie real estate appraisal. Highest and best use requires that the appraisal considers not just the current use of the property but also the potential value associated with alternative uses.

The income approach is one of three techniques commercial real estate appraisers use to value real estate. Compared to the other two techniques (the sales comparison approach and the cost approach), the income approach is more complicated, and therefore it is often confusing for many commercial real estate professionals. In this article, we’ll walk through the income approach to property valuation step by step, including several income approach examples.

Loss to lease is a commonly used calculation in a commercial real estate analysis. However, loss to lease can also be one of the most confusing calculations to understand, especially when you see it for the first time. In this article, we’ll take a closer look at the loss to lease calculations and walk through several examples to help you understand what it is and how it works.

Every investment involves a certain amount of risk. There are certain general sources of risk that influence all assets – things like geopolitical risk and global macroeconomic risk. What makes each asset unique is the level of sensitivity that its rate of return has to those risks. In addition, specific types of assets have risks that are uniquely their own. In this article, we’ll look at eleven types of risk in commercial real estate investment.

One of the unique challenges of commercial real estate investment is that markets, types of property, return expectations, and physical environments are in a constant state of change. As a result of these changes, a commercial property could be cash flow positive one day and undesirable the next due to shifts in tenant desires or some other factor. The real estate term for this type of risk is “obsolescence” and there are three types that CRE investors should be aware of.

When real estate investors are evaluating a potential rental property purchase or a bank is underwriting a potential loan, one of the first documents that they will ask for is the property’s “rent roll” or “rent roll report.” In this article, the rent roll document is described in detail and its utility in the CRE due diligence process is highlighted.

It is very common for a lender to require a borrower to open a checking account as part of the transaction. Because of this, it is critical that borrowers have awareness of a lightly understood and rarely enforced, but potentially devastating clause in a typical retail bank’s deposit account agreement known as the “Right of Offset.”

Compared to other loans, 504 loans offer savings that result in improved cash flow. The maximum loan amount is $5 million, or $5.5 million for small manufacturers or certain types of energy projects.

A seller's net proceeds sheet is a document that estimates the amount of money a seller will receive after all closing costs have been paid. The net proceeds of a sale are important to capital gains tax exposure because they determine the amount of profit that is subject to tax.

Improvements in NOI will improve your returns as well as your property value. To follow are a few ways you can lower your operating costs if you own a Multifamily Property.

Finance is a hot topic industry-wide, and while much of the concern concerns volatile economic factors, it’s more so the lack of clarity surrounding them. Everyone has different opinions regarding what might or might not happen, but it’s essential to look at the macro picture to find a solution.

Tenancy in common (TIC) is a real estate transaction in which there is more than one owner of a specific property.

Owner financing for commercial properties gives buyers and sellers more control over the transaction and enormous profits by cutting out the traditional commercial lender as a middleman.

Commercial real estate is the US's third most valuable asset class, right behind stocks and bonds. With an estimated market value of about $17 trillion, it’s understandable why many investors are adding commercial real estate to their investment portfolios. Let’s take a quick look at commercial real estate basics, including commercial real estate types and asset classes, and the best

Investing in commercial real estate property can be a rewarding and enjoyable experience when you are adequately prepared. Before you get involved with purchasing any property, you need to figure out how you will pay for your investment.

When evaluating investment opportunities, it is important to understand the difference between commercial and residential real estate. They are both vastly different beasts with their own unique sets of pros and cons.

Determining which rental property is worth your investment requires carefully looking at various bits of data. The gross rent multiplier in real estate happens to be one of the most important factors you may wish to focus on – and the good news is there are many such metrics you can use to get a good idea of the value of any property.

A few key practices and thought processes to maximize the return on your property upgrades and to help you select the improvements that will become a profit center and not just a cost.

Maintenance is as critical to your investment as any other component as staying ahead of issues can save you money, time and potential headaches.

While the possibilities to improve your community may be endless, we know that resources are not. With that in mind, we’ve considered the needs and preferences of today’s renters and focused on what upgrades could make the greatest impact. Here are the Top 5 New Apartment Amenities we think are worth considering for your 2023 community budget

While we don’t know how long we’ll be facing high inflation, investment properties will hedge against inflation for as long as you own them.

Utilities are one of the biggest expenses for apartment communities. And with inflation pushing the price of utilities to record-highs, it’s even more important that you’re keeping these expenses to a minimum.

Portfolio management can move from macro to micro through the proactive use of job category targeting across individual property rent rolls and overall diversification benefits from lower reliance on local labor markets

With so much discussion around rent payments and the prevailing misconception that rental housing owners enjoy large margins, the National Apartment Association (NAA) has released an explanation of the breakdown of one dollar of rent for 2022.

For many property investors, hiring a property manager is well worth the property management fees charged. It’s efficient to pay someone else who specializes in this work to take care of everything.