The growing need for rental properties will also continue to fuel growth in multifamily, AmTrustRE President Jonathan Bennett said. Space constraints will mean that entrepreneurial developers will need to work with municipal and zoning boards to increase potential development sites that feed the country’s housing stock, and focus on conversions.

In one of the biggest multifamily real estate deals in Chicago history, New York-based Emerald Empire bought the local portfolio of Pangea Properties in a sale exceeding $600 million.

With thousands of units delivered this year alone, some might call it a year for the books. The market itself remained strong, with rent up about 9% in Chicago YOY. Because of the delay in units being delivered as a result continued economic roadblocks, rent is predicted to remain robust throughout 2023.

In January, Bisnow polled CRE experts for their takes on what would be the dominant trends of 2022. Below, we break down what they got right and what they missed.

Real Estate Syndication is the phrase used to describe the concept of pooling the resources of and bringing together several different real estate investors in order to do a large commercial deal.

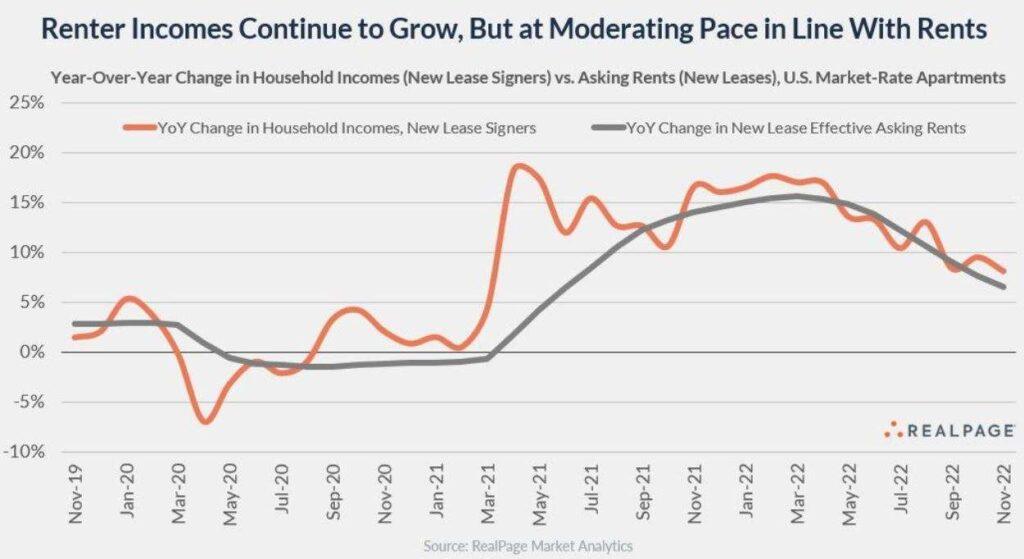

Renter incomes continue to grow, but the pace is moderating … and interestingly, the moderating pace of growth mirrors the trend in asking rents. Still, this is an encouraging trend for renter affordability — with household incomes among new lease signers up 8.1% year-over-year in November.