There are any number of reasons people sell their Commercial Real Estate Investments, but below are a few of the most common.

The number of Chicago-area renters earning $75,000 or more rose 38.8% between 2010 and 2018, says a national report from the Harvard Joint Center for Housing Studies.

New development is expected to exceed anticipated demand for the first time in years. Wage growth does not seem to be keeping pace with rental price increases and certainly, rent control measures could significantly impact investment – especially in the value-add segment of the market.

Whether your forecast for 2020 is exuberant or cautious, take advantage of the current environment to reassess and fortify your portfolio.

The Marcus & Millichap/IPA Multifamily Forums bring together the largest group of investors, financiers and decision-makers across North America. This creates a compelling incentive for sellers looking to showcase their properties to the most active qualified investors. No other firm moves capital across geographies and product types better than Marcus & Millichap. No other firm provides its agents and clients this type of opportunity.

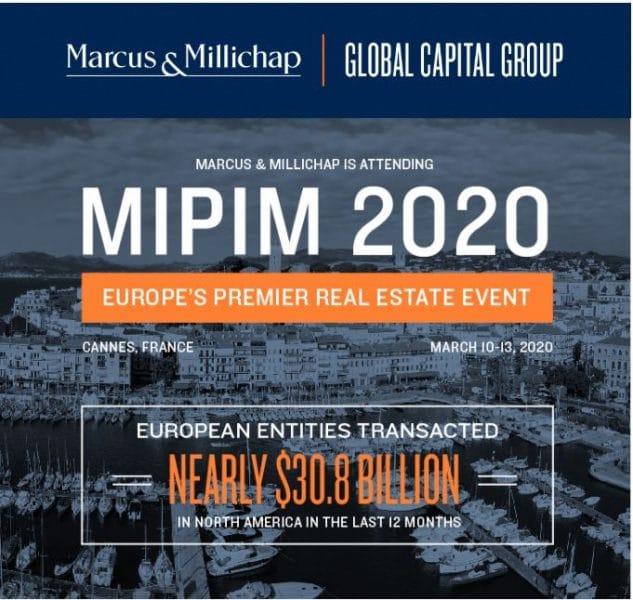

Expose your property to this vast investment capital pool through Marcus & Millichap’s presence at MIPIM, Europe’s premiere real estate event.