25% of people surveyed reported missing all or some of their rent that month. The federal program paying unemployed workers an extra $600 per week — a big help for renters — is set to expire in July.

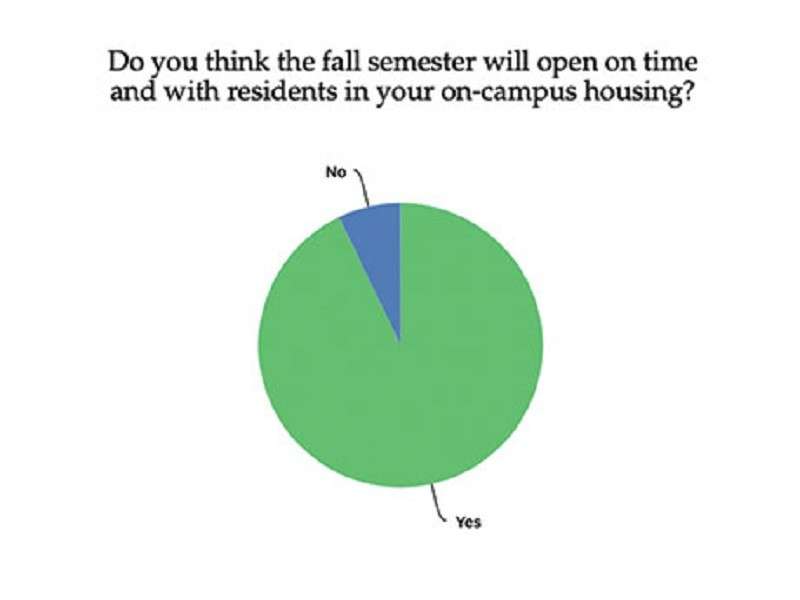

The outlook for the fall semester was overwhelmingly positive, with 93 percent of respondents indicating that they expect fall semester to open on time with residents in on-campus housing.

In the apartment world, now might be the time of the little investor. Regional Players Win Deals While Using Localized Knowledge to Their Advantage

Unlike traditional lenders who are hampered by the burdens of federal regulations, private lenders are nimble and can pivot to meet a range of market demands and unique circumstances.

This webcast will highlight:

Why investors use 1031 exchanges

The mechanics of tax-deferred exchanges

Real exchange examples to demonstrate the benefits

A strategic long-term perspective of real estate investing

Developers will likely delay starting new apartment projects until they see strong employment growth.