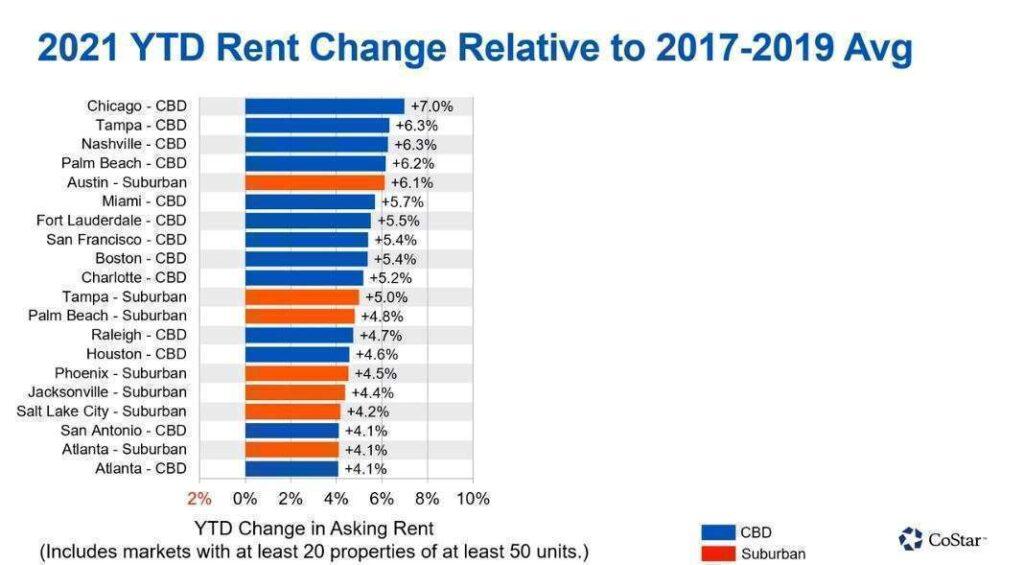

National apartment rents aren’t just recovering — they’re growing at a pace that would equate to the strongest apartment rent gains this century if maintained throughout the year, according to a CoStar Group analysis.

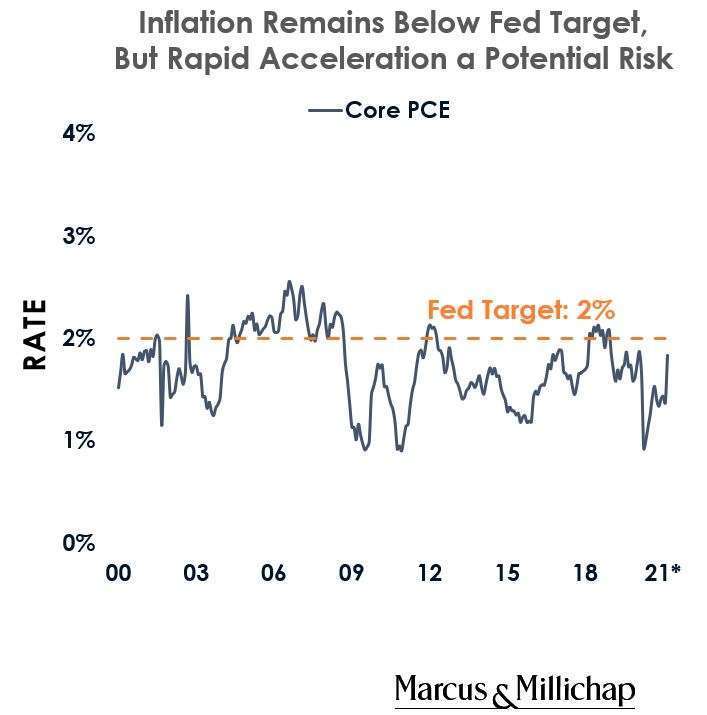

Early signs of rising inflation are beginning to show up in the marketplace

Marcus & Millichap is pleased to present to market a well-maintained, fully-occupied, and updated 14-unit multifamily offering in Blue Island, Illinois, a southern suburb of Chicago. The offering consists of an adjacent eight-unit and six-unit multifamily property with a total of eight one-bedroom one-bathroom units and six two-bedroom one-bathroom units.

Newly proposed tax reform that restricts 1031 Exchanges and increases capital gains taxes has the potential to significantly impact every commercial real estate investor.

The Fed assessment and other data show unemployment benefits, government stimulus checks and tax refunds have provided a substantial increase in personal income and purchasing power

The defining features of both cities and suburbs won’t be fundamentally changed by the pandemic, and as the recovery takes hold longer-term, both will likely continue to attract certain demographics over others.