Many investors remain in a holding pattern, awaiting additional clarity before they sell, restraining the flow of marketable inventory. This has exacerbated the expectation gap between buyers and sellers in many markets.

After apartments in U.S. gateway metros suffered big price cuts in much of 2020, effective asking rents are beginning to inch up again on a month-to-month basis.

Since the COVID crisis began, private investors helped drive the market, according to a recent report from Marcus & Millichap.

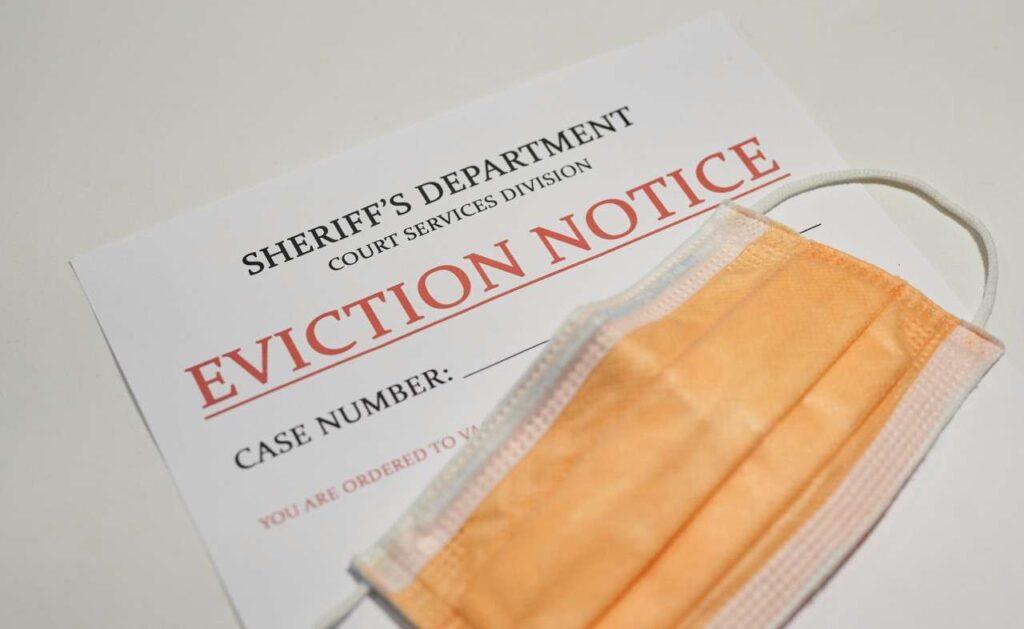

Illinois’ ban on residential evictions will end in August, more than a year after Gov. J.B. Pritzker imposed the emergency measure in response to the pandemic.

Gov. JB Pritzker is announcing $1.5B in housing assistance for Illinois renters and landlords affected during the pandemic. Eligible residents can receive up to $25,000 of assistance.

The problem is that the US just doesn’t have enough homes. The solution might be too expensive for homebuilders’ liking.