- Could low-interest rates and elevated capital flow into commercial real estate compress yields?

- Uncertain economic outlook and the traditionally limited alignment of cap rate and interest rate movement point to cap rate stability

- Asset pricing and yield will balance strong fundamentals against perceptions of future economic risk

Macro Factors Place Downward Pressure on Cap Rates

- Lower interest rates widened the yield spread, enabling buyers to underwrite more aggressively

- The increased flow of capital to CRE heightens demand for assets, placing downward pressure on cap rates

Interest Rates and Cap Rates Do Not Move in Lockstep

- Historically, cap rates and interest rates don’t move in direct tandem – ’13 interest rates rose but caps fell

- A prolonged stretch of falling rates, however, could support further cap rate compression

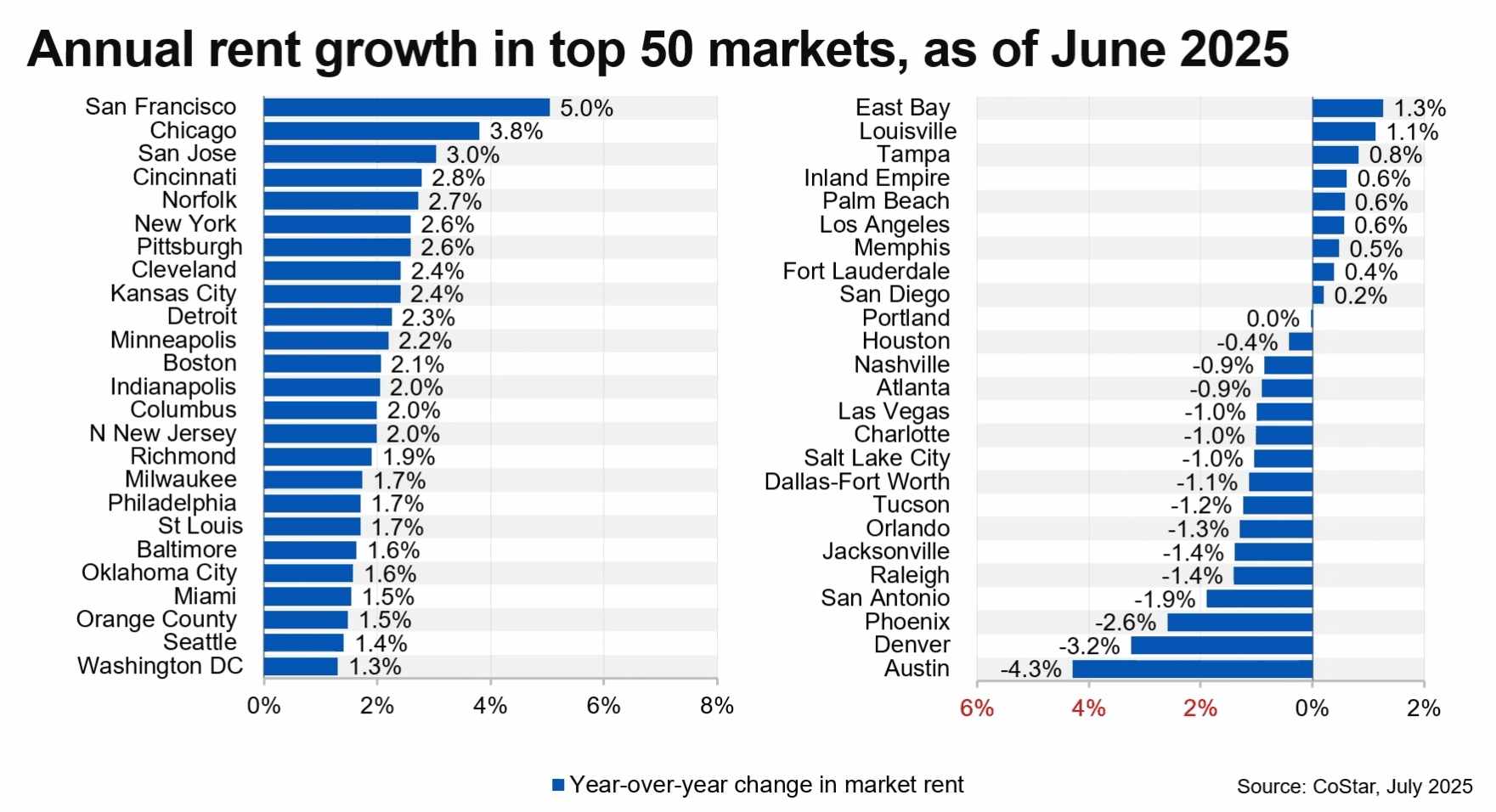

Wide Variance Across Property Types and Markets

- Apartment, STNL and well-located Industrial could see modest downward pressure

- Local market forces matter – Economy, population trends, legislation, etc. influence the outlook

Chicago Multifamily Research

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.