Even though higher interest rates can put pressure on commercial real estate sales prices, there are still compelling reasons to consider selling investment properties:

Capitalize on gains: If you have owned the property for a significant period, selling it now could help you realize gains from appreciation and accumulated equity. Waiting too long to sell could result in a decline in value or market downturn, resulting in reduced returns.

Diversification: By selling your commercial property, you can diversify your investment portfolio and reallocate your funds to other assets, such as stocks or bonds, or other real estate assets that may have a more favorable outlook.

Tax Benefits: Depending on the terms of the sale and your investment strategy, selling commercial real estate could provide tax benefits such as capital gains tax deferral or 1031 exchange.

Lower operating costs: Maintaining a commercial property comes with significant costs such as property taxes, maintenance, insurance, and other fees. Selling the property could relieve you of these expenses, allowing you to reinvest in other profitable ventures.

Increased liquidity: Selling commercial property could provide you with cash liquidity, which you can use to seize opportunities or invest in ventures with a higher potential return on investment.

While higher interest rates can put pressure on sales prices for commercial real estate, there are still compelling reasons to consider selling investment properties, including the potential for diversification, tax benefits, capital gains, lower operating costs, and increased liquidity.

Receive Market Insights

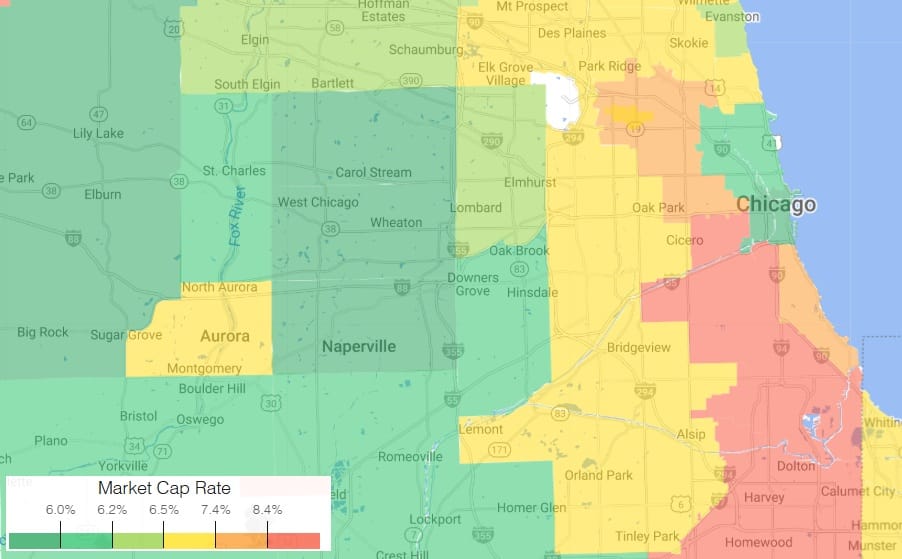

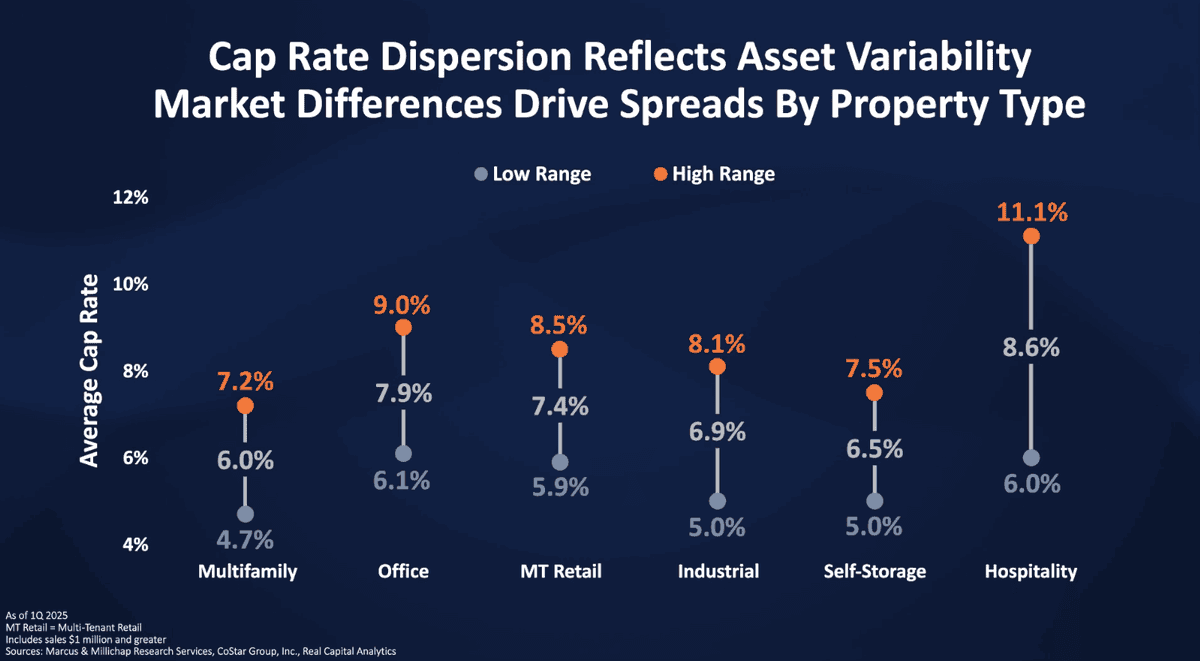

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.

Well written