Want to make smart moves in multifamily real estate investing? You must get familiar with cap rates.

These handy figures give you crucial intel on potential investments—think profitability, risk levels, all that good stuff. When it comes to larger apartment properties, understanding cap rates is a must if you want to make informed decisions.

But cap rates aren’t always straightforward. To really harness them for your investing strategy, you need to know the ins and outs.

In this comprehensive guide, we’ll dig into multifamily cap rates from all angles. You’ll discover how to calculate them, how to interpret them, and, most importantly, how to use them to maximize returns and minimize risk.

Let’s get into it.

What is a multifamily cap rate?

At its core, a cap rate is a handy financial metric for real estate investors. It lets you quickly size up the potential return you could get from buying an apartment property.

Technically speaking, it’s calculated by dividing the property’s net operating income (NOI) by its current market value. This gives you the rate of return as a percentage. Simple enough so far!

Now, cap rates are useful for two big reasons:

- They show the potential property return regardless of how it’s financed—no factoring in mortgages or taxes. Think of it as approximating what you could earn in Year 1 of ownership.

- They give you insight into the investment risk level. Generally, a higher cap rate means more risk but potentially bigger returns. A lower cap rate suggests lower risk but smaller earnings. See the trade-off?

In essence, multifamily cap rates present a handy risk/return balance. You get to size up potential profits and the associated risks—super helpful intel for real estate investment decisions!

How to Calculate a Multifamily Cap Rate

Crunching the numbers on a multifamily cap rate is pretty straightforward. Here’s the formula:

Cap Rate = Net Operating Income / Current Market Value

Let’s break down the components:

- Net Operating Income (NOI): This is the property’s total revenue minus all operating expenses over a 12-month period. Operating expenses include maintenance, repairs, property management fees, utilities, taxes, and insurance—all the costs needed to run the property.

- Current Market Value: The property’s fair market value at the present time. Comparable sales, or the price of similar properties that have recently sold in the area, are typically what determine this.

- Cap Rate: The NOI divided by the current market value, represented as a percentage.

For example:

A multifamily property has an NOI of $1,000,000 and a market value of $12,000,000.

The cap rate would be:

$1,000,000 / $12,000,000 = 0.0833

Expressed as a percentage, the cap rate is 8.33%

Pretty simple math, but those tiny percentages can make or break an investment decision!

How Cap Rates are Used in Multifamily Real Estate Investment

So we now know what cap rates are, but how do real estate investors actually use them when evaluating multifamily properties? Let’s explore some key applications:

- Asset Valuation: Cap rates give a quick snapshot of how a property may perform relative to the purchase price. This allows for comparing potential investments to see which could generate better returns.

- Investment Recovery: The cap rate also indicates how quickly you could potentially recoup the initial investment. A higher cap rate usually means a faster payback period, which is helpful for comparing deal terms.

But it’s not all sunshine and roses! Here are some limitations to keep in mind:

Cap rates don’t account for financing costs or future changes in income/value, and they also ignore capital improvements and vacancy rates. While super useful for initial assessment, cap rates shouldn’t make or break an investment decision.

The key is using cap rates as one tool among many when analyzing potential multifamily purchases. Check the cap rate, but also dig deeper into the property’s finances, condition, market, and your own investing goals.

Multifamily Cap Rates vs Gross Rent Multiplier

When eyeing multifamily investments, you’ll likely encounter two key metrics: cap rates and gross rent multipliers (GRM). At first glance, they seem similar, but there are some important differences between the two.

The GRM simply divides the purchase price by the property’s total potential rental income; it doesn’t account for operating expenses.

Cap rates, on the other hand, factor in both income and expenses to give a more complete profitability picture.

The main advantage of cap rates is their ability to evaluate and compare investment returns, risks, and value. For this reason, they tend to be a more reliable tool for real estate investors.

GRMs still have their uses, like estimating value if rents increase, but for determining true investment potential, cap rates generally provide more insightful information.

When running the numbers on a property, calculate both metrics. Just keep in mind that leaning more heavily on the cap rate will help you make informed investment decisions that maximize your returns and minimize risk.

What is considered a good multifamily cap rate?

The short answer is that it depends! There’s no universal standard since it relies on two main variables: your investing objectives and current market conditions.

Some key factors influencing a good cap rate include:

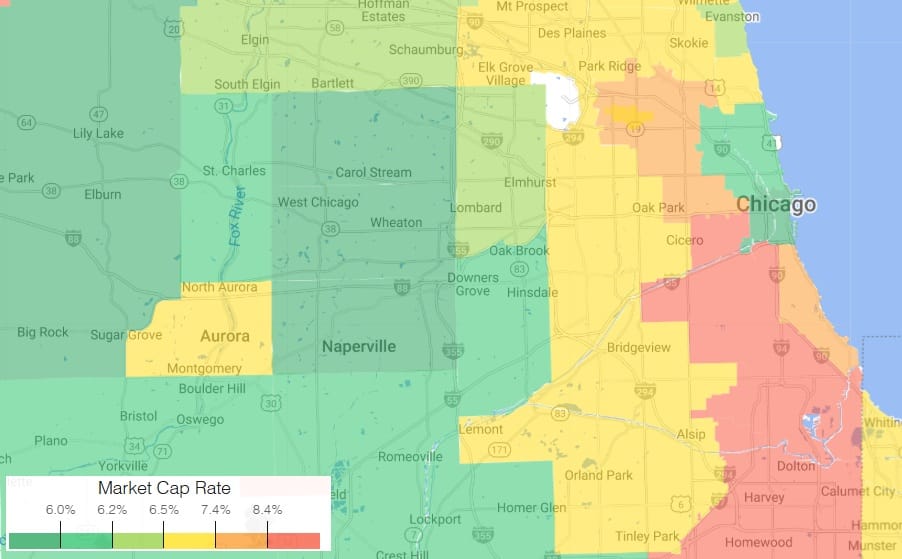

- Property location

- Building condition

- Asset type (class A, B, C)

- Overall real estate market dynamics

Taking these into account helps set realistic cap rate expectations, but historically, rates between 4 and 10% are often seen as solid.

Of course, a “good” cap rate for you might fall outside that range based on your investing goals and the specific property/market, so don’t get hung up on chasing a specific cap rate number.

Focus instead on how the rate fits into your overall investing strategy and the market landscape, and let your particular objectives and the property details guide your definition of a “good” cap rate.

Conclusion

So now you’re armed and ready! You’ve got a complete understanding of cap rate calculations, applications, limitations, and how to interpret them.

Bring this knowledge into your next multifamily property evaluation to let cap rates guide you toward lucrative investments with lower risks.

Ready to explore multifamily properties with great potential? Contact us for personalized investment advice and opportunities.

Source: Understanding Multifamily Cap Rates: Calculations, Interpretation, and Maximizing Returns

Receive Market Insights

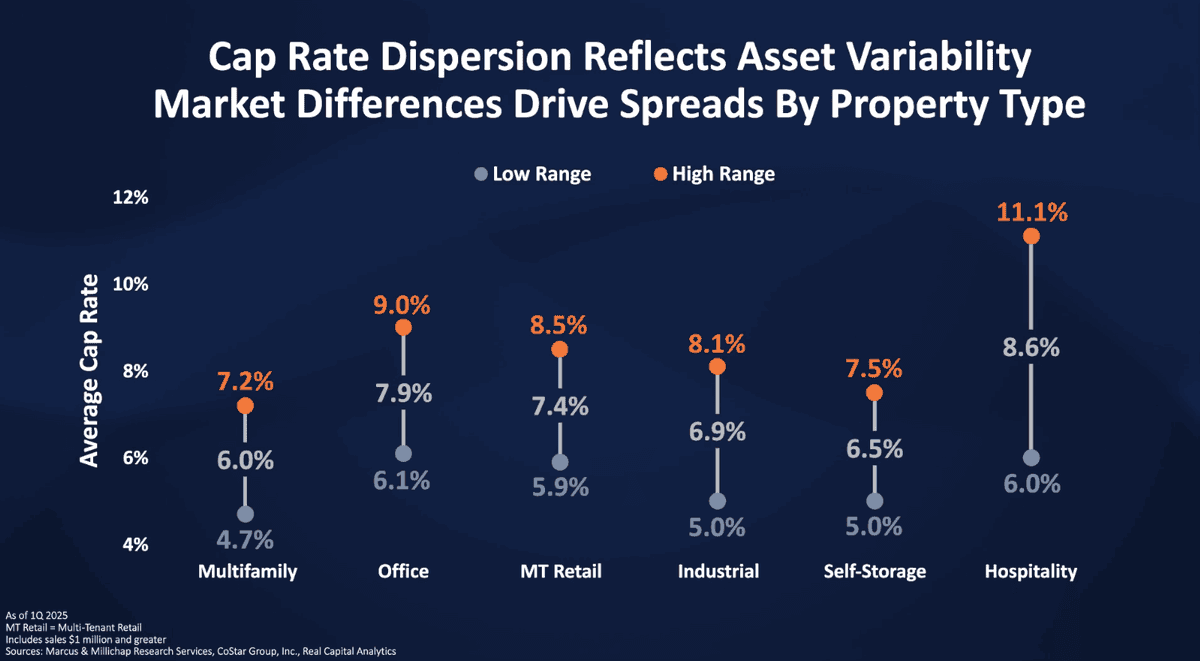

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.