Maximizing Your Multifamily Property’s Sale Potential: A Comprehensive Preparation Guide

Navigating the multifamily property sales landscape can be a complex endeavor, requiring careful planning, strategic execution, and expert guidance. To ensure a seamless and profitable sale, thorough preparation is essential. This comprehensive guide outlines the key steps involved in preparing your multifamily property for sale, empowering you to achieve its full market value.

Step 1: Assemble Essential Financial Documents

Rent Roll: A detailed rent roll provides potential buyers with a clear overview of the property’s income stream. Include tenant names, unit numbers, monthly rents, lease terms, and any outstanding balances.

T12 Income and Expenses: This statement summarizes the property’s financial performance for the past 12 months. It should include gross rental income, operating expenses, and net operating income (NOI).

Capital Improvement List: Document all significant capital improvements made to the property, such as renovations, upgrades, or new amenities. This demonstrates the property’s well-maintained condition and future potential.

Step 2: Enhance Property Appeal

Curb Appeal: First impressions matter. Ensure the property’s exterior is inviting and well-maintained. Address any visible issues, such as landscaping, walkways, and parking areas.

Interior Condition: Conduct a thorough inspection of all units and common areas. Address any maintenance concerns, including painting, lighting, and flooring repairs.

Vacant Units: Stage vacant units to showcase their potential. Consider decluttering, fresh paint, and minor cosmetic upgrades.

Step 3: Engage an Expert Commercial Real Estate Broker

Expertise: Seek a broker with a proven track record of success in multifamily property sales. Their expertise will guide you through the complexities of the market and maximize your sale price.

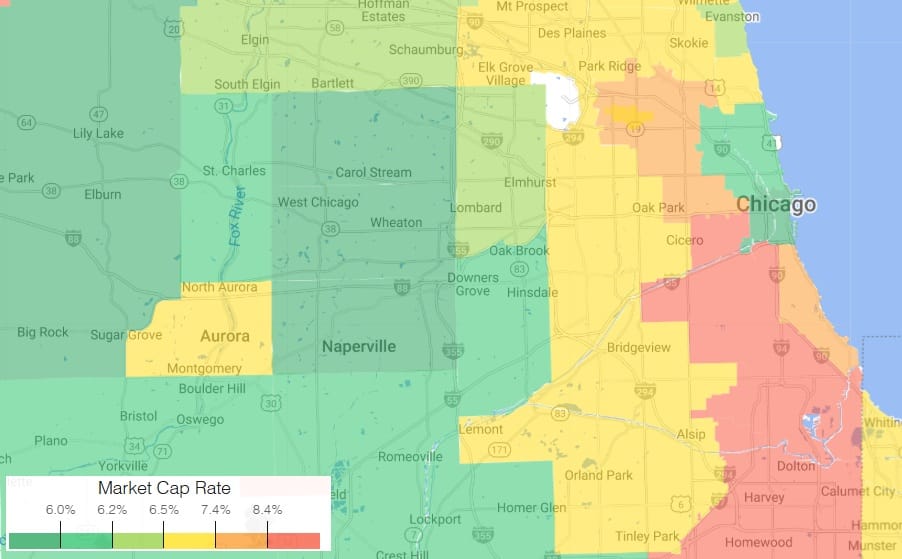

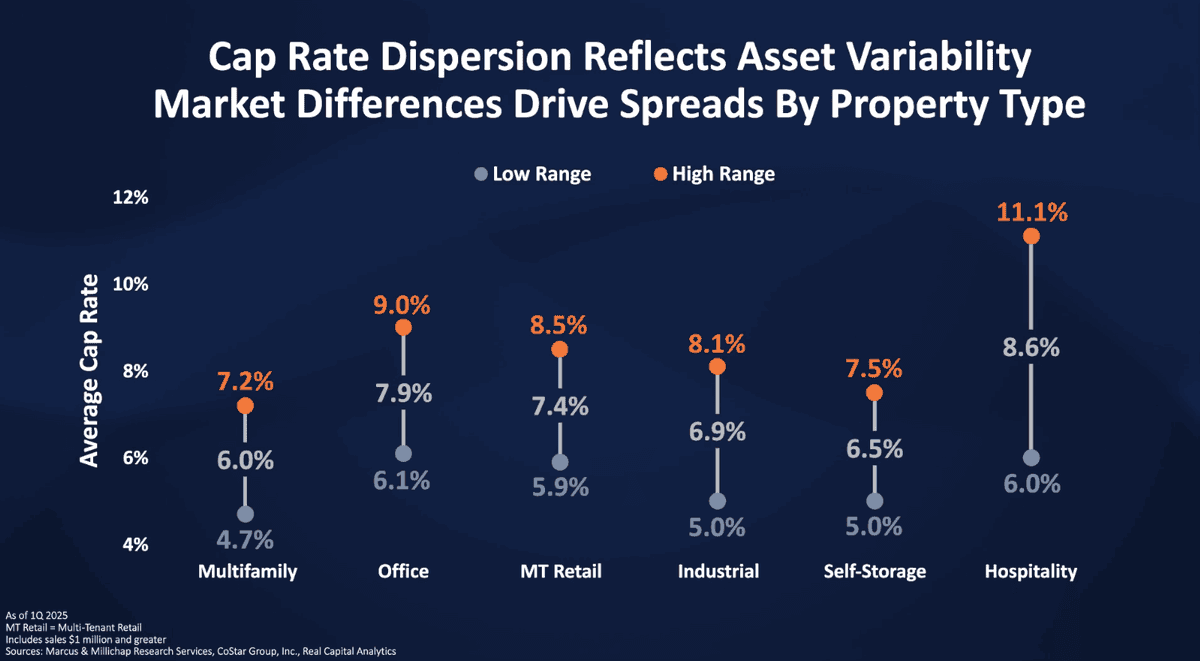

Market Insights: A knowledgeable broker will provide valuable insights into current market trends, comparable sales, and buyer preferences, ensuring your property is positioned competitively.

Negotiation Skills: An experienced broker will advocate for your best interests during negotiations, securing favorable terms and maximizing your return on investment.

Step 4: Prepare for Due Diligence

Organized Records: Maintain meticulous records of all financial documents, property information, and historical maintenance records. This will expedite the due diligence process and demonstrate your professionalism.

Transparency: Be forthcoming with all information about the property, including any known defects or potential issues. Transparency fosters trust with potential buyers and avoids surprises during due diligence.

Proactive Approach: Anticipate potential due diligence requests and prepare responses promptly. This demonstrates your preparedness and commitment to a smooth transaction.

By following these comprehensive preparation steps and enlisting the expertise of a reputable commercial real estate broker specializing in multifamily sales, you can position your property for a successful and profitable sale. Remember, thorough preparation, strategic positioning, and expert guidance are the keys to unlocking the full value of your multifamily investment.

[ux_html][/ux_html][/col][/row]

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.