IRS Loosens Timelines for 1031-Exchange Buyers

Section 1031 of the Internal Revenue Code enables real estate investors to defer capital gains on income-producing property when those gains are used to acquire a like-kind investment. Colloquially, a 1031 exchange is the transaction in which an investment property is liquidated and the proceeds from the sale, including capital gains, are used to acquire additional income-producing property or properties. For the exchange to meet IRS standards, buyers have 45 days from the initial sale to identify a replacement property of equal or greater value and 180 days to acquire that asset.

In an effort to relieve pressure on 1031 timelines while much of the country is shut down and lenders are focused on processing thousands of loans initiated under the CARES Act, the IRS has temporarily altered the requirements to meet its standard. Under the new guidance, both the identification and acquisition of the replacement property or upleg, has been extended. If the identification deadline falls between April 1 and July 15, the new deadline is July 15. Likewise, if the 180-day purchase deadline falls between April 1 and July 15, the new deadline is moved to July 15. Further guidance from the IRS may be necessary due to a conflict with existing rules in Section 17 of Rev. Proc. 2018-58 that extended 1031-exchange timelines during a federally declared disaster.

The implications of the altered guidance will impact all stakeholders active in the 1031-exchange market, including a significant number of investors already on the upleg of a transaction. Shelter-in-place orders slowed the pace of closings, which could have left some investors responsible for capital gains taxes despite identifying a replacement property and attempting to purchase the asset within the allowable window. As investors seek clarity on conditions, some identifications may be delayed until closer to the July 15 deadline, creating a potential new bottleneck on intermediaries.

Investors will welcome additional breathing room at a time when most steps in the process are taking additional time. The pressure on buyers to identify a property that will close quickly rather than one that meets investment goals has been alleviated, and longer due diligence periods may change the type of attractive properties they can identify. It reiterates to sellers that the investment market continues to close transactions despite headwinds. Furthermore, the attractiveness of existing available properties may change as buyers reevaluate post-pandemic conditions.

Marcus & Millichap Capital Group

Receive Market Insights

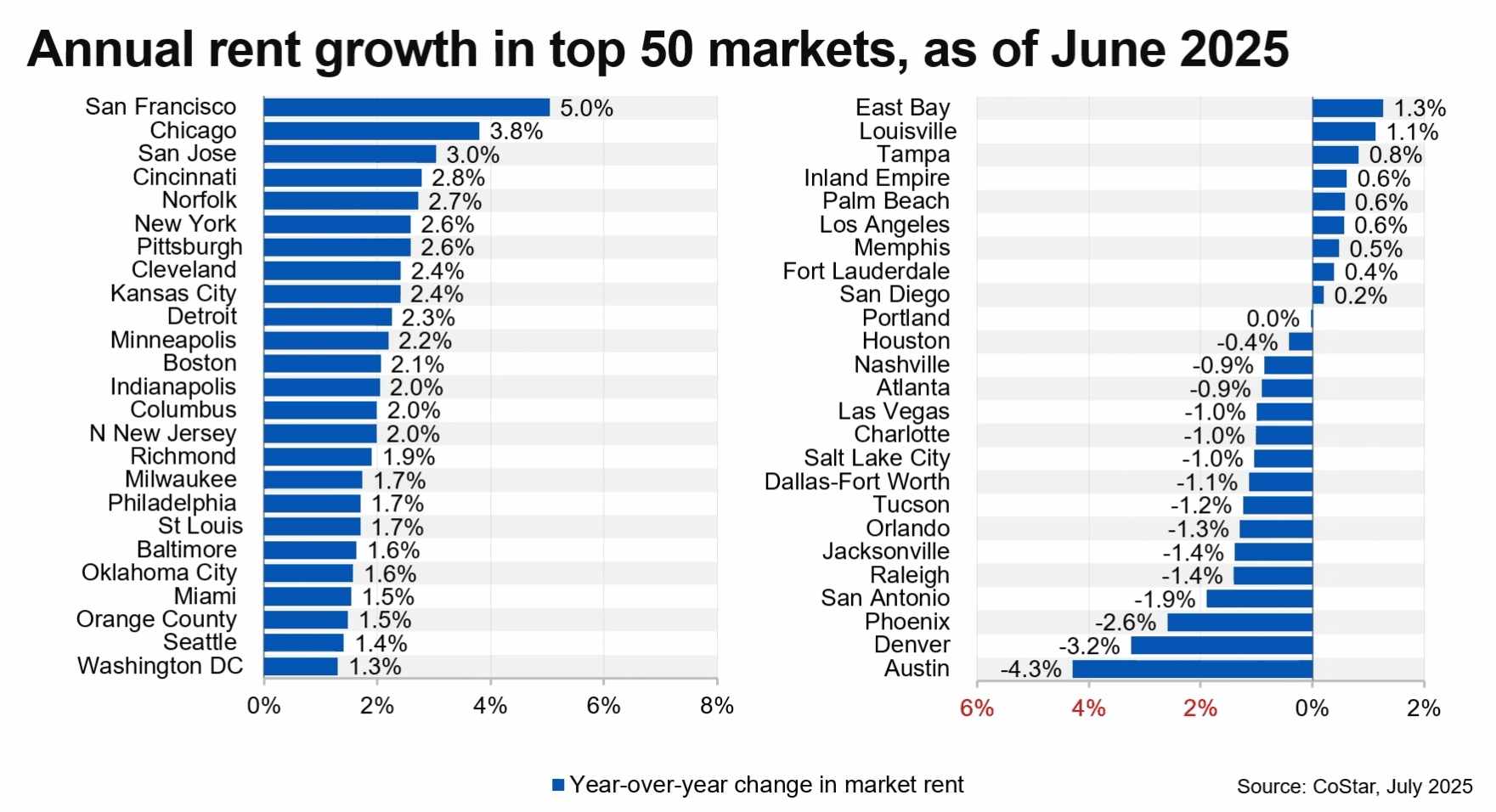

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.

Join The Discussion