Prices have climbed so high it will take some time for them to come back down to earth. In other words, the uncomfortable inflation numbers of 2021 will likely stay with us well into the New Year.

The latter index is what the Federal Reserve pays the most attention to when assessing the nation’s inflation.

and the PCE indices. That’s good news, even though the slowdown was small at only 0.1 percentage points.

But here’s the thing: Economists prefer to look at price movements over a period of time, usually 12 months. So a small slowdown like November’s won’t move the needle just yet.

In fact, it might take months for these incremental slowdowns to show up in the data. After a year of prices soaring on high demand and supply chain chaos, a lot of big numbers are baked into the 12-month data set. Even if inflation suddenly falls off a cliff, it would take time for the leading indices to reflect that. This is what Fed Chair Jerome Powell is talking about when he mentions “base effects.”

Why will inflation remain high?

Several factors are keeping prices elevated.

One is the supply chain chaos that came to a head last summer. Even though some bottlenecks have eased, the issues are not fully resolved. And as long as it’s more expensive — and takes more time — to move goods around the world, higher transport costs will likely be passed down to consumers.

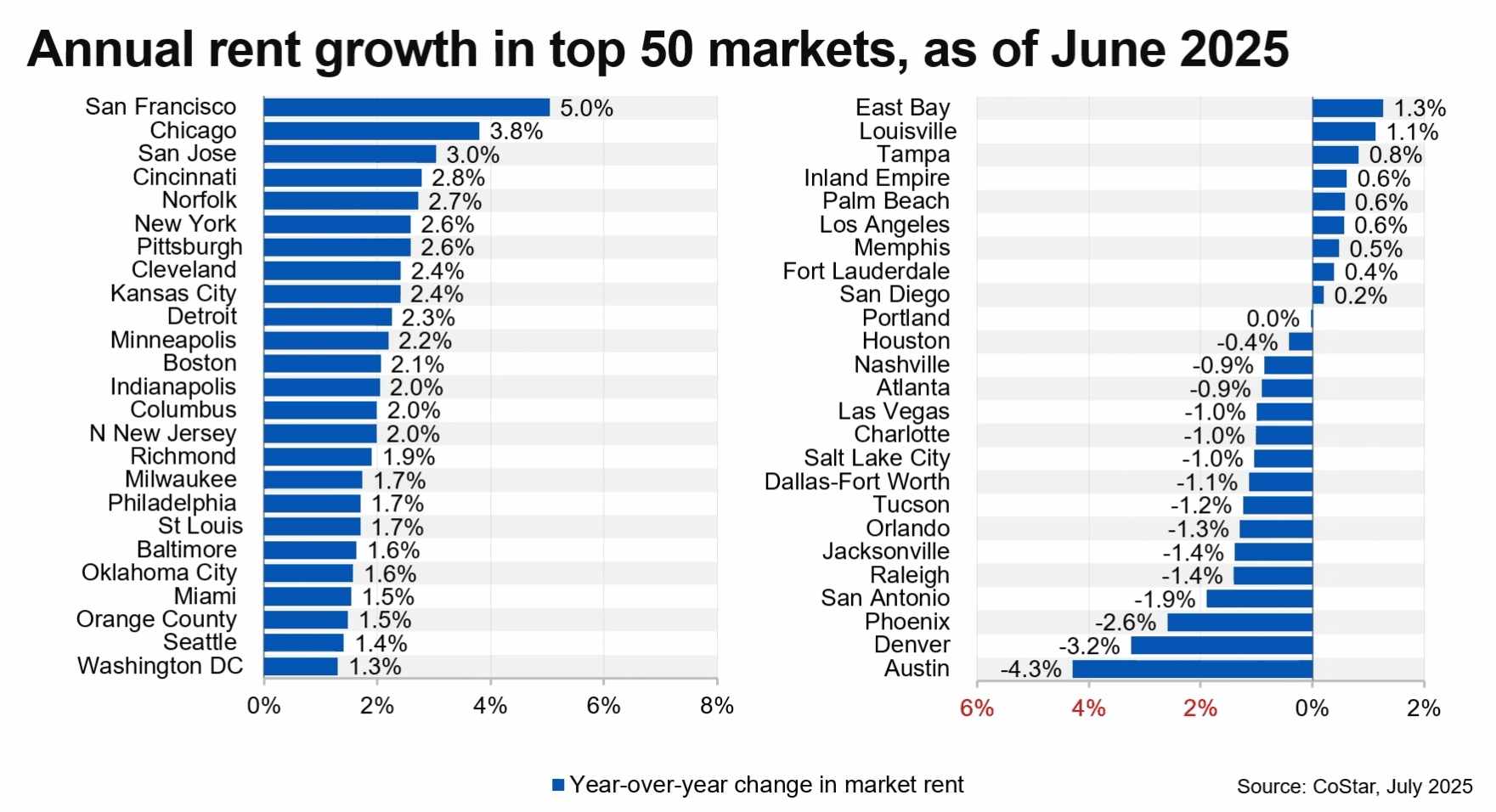

Rising rents also remain a concern. This is important because housing represents a big percentage of what people spend money on. If rents eat up a bigger piece of the pie, consumers might wind up spending less, which would be bad news for the recovery.

In November, rent rose 0.4% for the third month in a row, according to economists at Bank of America, and that points to higher and more persistent inflation going forward.

The “recent broadening of inflationary pressure has coincided with a notable pickup in rental inflation,” said Peter B. McCrory, economist at JPMorgan, “which jumped to its highest monthly rate in 20 years in the September CPI report and has stayed firm since then.”

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.