2025 Multifamily Market Outlook: CMBS & Investment Trends

The 2025 Multifamily Market Outlook presents both opportunities and risks for investors navigating the commercial real estate (CRE) market. While rising interest rates and economic volatility have impacted CRE valuations, multifamily remains one of the most resilient asset classes.

Despite a 20.4% decline in apartment values, rental demand, CMBS issuance trends, and stabilizing interest rates signal strong investment potential in 2025.

This article explores market trends, financing conditions, and investment strategies shaping multifamily real estate in 2025, using insights from Moody’s Global CMBS & CRE CLO webinar.

Multifamily Real Estate: Stability Amid Market Volatility

1. Multifamily Property Values Declined, But Less Than Other Sectors

According to Moody’s 2025 CMBS & CRE CLO Outlook, multifamily property values fell 20.4% in 2024. However, this was less severe than other asset classes, such as:

- Hotels: -22.9%

- Retail: -12%

- Office: -9.4%

- Industrial: +7.0% (the only sector with value growth)

Key factors influencing multifamily performance:

- Steady housing demand – Homeownership remains expensive, keeping rental demand strong.

- Interest rate stabilization – Lower floating rates will ease financing costs.

- CMBS issuance trends – Multifamily-backed CMBS issuance increased in Q3 and Q4 2024.

📌 Takeaway: Multifamily is outperforming retail, office, and hotels, but investors should monitor regional supply and rent growth trends.

2. CMBS & CRE CLO Financing Trends for Multifamily in 2025

Rising interest rates in 2023-2024 made refinancing more expensive, affecting multifamily investment. However, Moody’s forecasts interest rates to stabilize in 2025, improving financing conditions.

How Interest Rates Will Impact the 2025 Multifamily Market

- Easier Refinancing – Borrowers with maturing CMBS loans will face fewer refinancing challenges.

- Debt Service Coverage Ratios (DSCR) Remain Stable – Moody’s reports multifamily DSCR at ~1.2x, meaning most properties generate enough rental income to cover debt payments.

- Increased CMBS Issuance – Multifamily-backed CMBS deals increased in Q4 2024, showing lender confidence.

📌 Investor Takeaway: CMBS and CRE CLO issuance trends suggest stronger multifamily lending in 2025, particularly in high-growth rental markets.

3. Multifamily vs. Other CRE Sectors: 2025 Performance Outlook

| Property Type | Value Change (2024) | Key Risks | 2025 Investment Outlook |

|---|---|---|---|

| Multifamily | -20.4% | Insurance costs, supply concerns | Moderate Growth |

| Retail | -12% | E-commerce competition, store closures | Mixed Outlook |

| Office | -9.4% | High vacancy rates, remote work trends | High Risk |

| Industrial | +7.0% | Strong e-commerce demand, logistics expansion | Strong Growth |

| Hotels | -22.9% | Economic downturn, lower travel demand | Volatile |

📌 Takeaway: Multifamily remains a top CRE investment choice but lags behind industrial properties, which are thriving due to logistics and e-commerce growth.

4. Emerging Risks & Challenges for Multifamily Investors

a) Rising Insurance Costs & Climate Risk Exposure

- Insurance costs have spiked in high-risk regions (Gulf Coast, wildfire-prone areas).

- Natural disasters increase property expenses and insurance premiums, impacting cash flow.

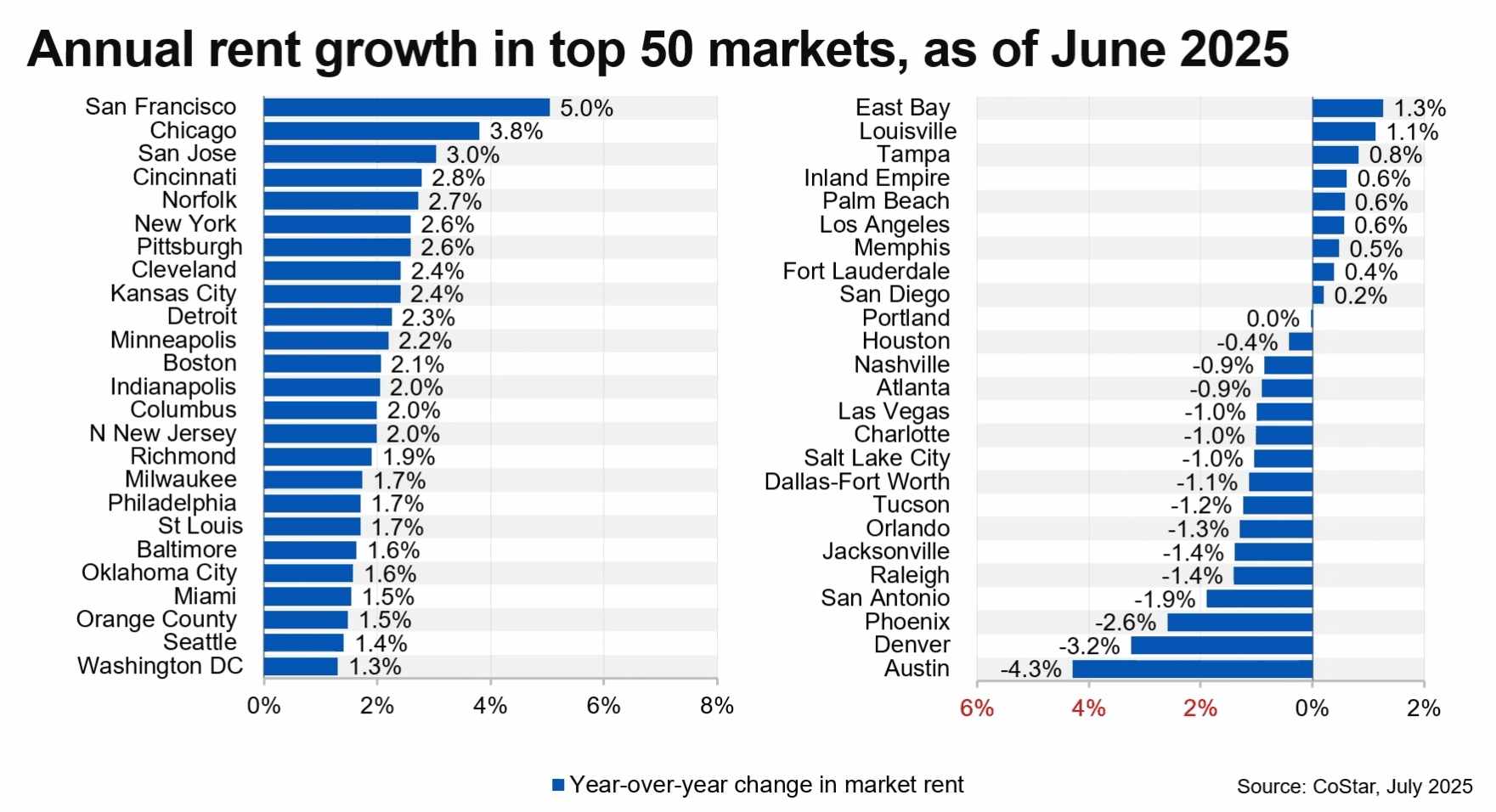

b) Rent Growth Slowing in Some Markets

- Oversupply risk in cities with high apartment construction (e.g., Austin, Phoenix) is slowing rent growth.

- Coastal metro areas (NYC, LA, Miami) continue to see rental price appreciation due to housing shortages.

c) Workforce Housing & Affordable Rentals in Demand

- Class B & C apartments have higher occupancy rates as affordability becomes a greater concern.

- Investors focusing on affordable rentals may benefit from stable cash flow and lender support.

📌 Investor Takeaway: Markets with oversupply and high insurance costs should be analyzed carefully before investing.

5. Investment Strategies: Where to Focus in 2025?

Best Multifamily Investment Strategies for 2025

✔ Urban Multifamily in High-Growth Markets

- Best Markets: Miami, Dallas, Atlanta, Denver

- Strong employment growth and rental demand

✔ Class B & C Workforce Housing

- More recession-proof than luxury apartments

- High occupancy rates and stable cash flow

✔ Value-Add & Distressed Acquisitions

- Some underperforming assets can be repositioned for higher returns

- Look for distressed properties in high-rent areas

📌 Investor Tip: Watch CMBS issuance trends and local market supply before making new acquisitions.

6. Final Thoughts: The 2025 Multifamily Market Outlook

The multifamily sector remains one of the most stable CRE asset classes, driven by:

- Strong rental demand

- Improving financing conditions

- Resilient CMBS issuance trends

However, investors must navigate risks, including higher insurance costs, regional supply imbalances, and economic shifts.

Key Takeaways for Investors:

✔ Interest rates are stabilizing, making refinancing easier.

✔ Multifamily CMBS delinquencies remain lower than other CRE sectors.

✔ Affordable housing investments offer strong occupancy rates and cash flow stability.

✔ Investors should focus on high-growth rental markets and properties with strong cash flow fundamentals.

📌 Final Thought: Multifamily remains a top-performing CRE sector, but smart investors should focus on rental demand trends, financing conditions, and risk management.

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.