CHICAGO MULTIFAMILY SALES

Specialized Brokerage for Apartment Owners -Driven by eXp Commercial’s National Multifamily Division

WHY CHICAGO APARTMENT OWNERS TRUST OUR MULTIFAMILY BROKERAGE

As part of eXp Commercial’s National Multifamily Division, CREConsult delivers full-service brokerage solutions built to maximize seller proceeds. Our process integrates data-driven valuations, strategic asset positioning, and targeted buyer outreach to generate competitive bidding and premium outcomes.

Multifamily Sales Expertise for Chicago Apartment Owners

CREConsult specializes exclusively in Chicago-area multifamily property sales, delivering accurate valuations, targeted investor marketing, and proven results for owners ready to sell or evaluate disposition options.

Proven Record

25+ years advising Chicago apartment owners on valuation, positioning, and execution across changing cycles.

Investor Network

Direct access to active private, 1031, and institutional buyers targeting Chicago multifamily assets.

Data Driven Analysis

Cap rate, rent roll, and submarket analytics aligned with targeted digital campaigns to drive competitive offers.

Recent Closings

A track record of successful multifamily dispositions, highlighting the pricing performance and market reach delivered for Chicago apartment owners.

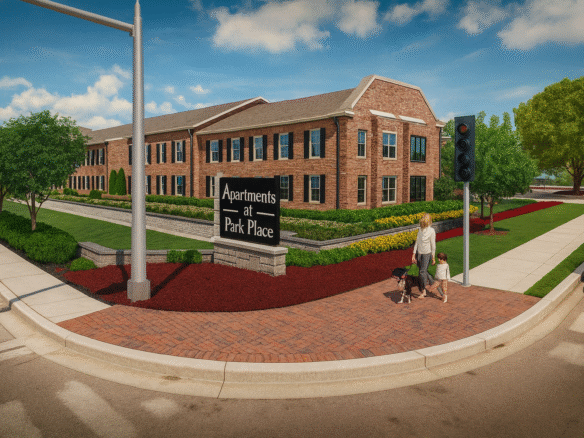

9250 S Kedzie Ave Evergreen Park | 6-Unit Multifamily Mixed-Use

- 4854 SF

- Units: 6

- 0.3 SF

- Mixed Use, Multifamily

- $515,000

9250 S Kedzie Ave Evergreen Park | 6-Unit Multifamily Mixed-Use

- 4854 SF

- Units: 6

- 0.3 SF

- Mixed Use, Multifamily

1900 Broadway St Blue Island | 84-Unit Multifamily

- 100800 SF

- Units: 84

- 2.79 SF

- Multifamily

751-757 N 5th Ave Kankakee | 32-Unit Multifamily

- 31000 SF

- Units: 32

- 1.68 SF

- Multifamily

30 Briar St Glen Ellyn | 12-Unit Multifamily

- 16479 SF

- Units: 12

- .58 SF

- Multifamily

100 West Roosevelt Rd Wheaton | 22-Unit Multifamily

- 23864 SF

- Units: 22

- 1.51 SF

- Multifamily

991 – 1021 Tollview Aurora | 24-Unit Multifamily

- 22600 SF

- Units: 24

- 2.41 SF

- Multifamily

631 E Lincolnway Morrison | 23-Unit Multifamily

- 34714 SF

- Units: 23

- 0.8 SF

- Multifamily

1015 – 1025 N Farnsworth Ave Aurora | 24-Unit Multifamily

- 23652 SF

- Units: 24

- 2.7 SF

- Multifamily

834 Victoria Dr Montgomery | 152-Unit Multifamily

- 116032 SF

- Units: 152

- 8.57 SF

- Multifamily

105 E Grove St Lombard | 12-Unit Multifamily

- 7208 SF

- Units: 12

- 0.32 SF

- Multifamily

924 E Willow St Kankakee | 21-Unit Multifamily

- 10000 SF

- Units: 21

- 0.33 SF

- Multifamily

109 S Whispering Hills Dr Naperville | 4-Unit Multifamily

- 3772 SF

- Units: 4

- 0.13 SF

- Multifamily

1664 Molitor Rd Aurora | 16-Unit Multifamily

- 16896 SF

- Units: 16

- 1.74 SF

- Multifamily

1124 E Adams St Macomb | 23-Unit Multifamily

- 32422 SF

- Units: 23

- 0.88 SF

- Multifamily

1125 Tollview Ave Aurora | 10-Unit Multifamily

- 8400 SF

- Units: 10

- 0.54 SF

- Multifamily

1231 N Galena Ave Dixon | 21-Unit Multifamily

- 23162 SF

- Units: 21

- 0.85 SF

- Multifamily

13046 Wood St Blue Island | 18-Unit Multifamily

- 15540 SF

- Units: 18

- 0.49 SF

- Multifamily

1601 Reckinger Rd Aurora | 12-Unit Multifamily

- 12206 SF

- Units: 12

- 0.5 SF

- Multifamily

1603 Reckinger Rd Aurora | 12-Unit Multifamily

- 17400 SF

- Units: 12

- 0.59 SF

- Multifamily

163 N Rosewood Ave Kankakee | 12-Unit Multifamily

- 3998 SF

- Units: 12

- 0.33 SF

- Multifamily

2149-2151 119th St Blue Island | 5-Unit Multifamily

- 11527 SF

- Units: 5

- 0.15 SF

- Multifamily

301 S Ottawa St Joliet | 6-Unit Multifamily

- 6500 SF

- Units: 6

- 0.42 SF

- Multifamily

4337 Prescott Ave Lyons | 12-Unit Multifamily

- 13005 SF

- Units: 12

- 0.31 SF

- Multifamily

455 Green Oaks Ct E Addison | 24-Unit Multifamily

- 24321 SF

- Units: 24

- 1.16 SF

- Multifamily

557-559 Ashland Ave Aurora | 12-Unit Multifamily

- 11400 SF

- Units: 12

- 0.12 SF

- Multifamily

Testimonials

What Chicago Apartment Owners Say About Working With Randy Taylor

RECENT MARKET INSIGHTS

Actionable updates on Chicago multifamily trends, valuation shifts, cap rates, and market fundamentals for apartment building owners and investors.

Frequently asked questions

How do we determine the market value of your Chicago apartment building?

We evaluate rental income, operating expenses, location, and comparable sales. Our valuation process analyzes cap rates, rent rolls, T-12 financials, and recent Chicago multifamily transactions to determine true market value. Our complimentary broker opinion of value provides clarity on your building’s current position and upside potential.

How can you increase your property’s value before selling?

We focus on improvements that deliver measurable ROI—unit upgrades, rent optimization, expense reduction, and exterior enhancements. Targeted upgrades often attract stronger buyers and higher pricing. We advise owners on the improvements that have the greatest impact in today’s Chicago multifamily market.

What are the current multifamily cap rates in Chicago?

Cap rates vary by submarket and asset class. Core Chicago neighborhoods often trade in the 5%–6% range, while suburban properties typically fall between 6%–7.5%. Condition, unit mix, and financing availability influence investor expectations. We track live market data to ensure clients receive accurate and current cap rate guidance.

How long does it take to sell an apartment building in Chicago?

Most Chicago-area multifamily properties sell within 60–120 days depending on pricing, tenant stability, property condition, and deal size. Institutional buyers often move faster when financing is secured. We manage full marketing, negotiations, and due diligence to compress timelines and maximize your proceeds.

What is the best time of year to list a multifamily property?

Investor activity is highest from spring through early fall, but strong buyers remain active year-round. Well-positioned and correctly priced assets perform consistently regardless of season. We tailor each launch strategy to current market demand and investor behavior.

How does a 1031 exchange impact your Chicago apartment sale?

A 1031 exchange allows sellers to defer capital gains taxes by reinvesting into another investment property. The rules are strict—45 days to identify replacement properties and 180 days to close. We coordinate with qualified intermediaries to ensure a seamless process aligned with your sale timeline.

How can you prepare your apartment building for sale?

We recommend assembling all leases, rent rolls, expense records, and maintenance logs. Address deferred repairs and confirm compliance with Chicago and Cook County requirements. Clean financials and organized operations help generate stronger offers and a smoother closing.We focus on improvements that deliver measurable ROI—unit upgrades, rent optimization, expense reduction, and exterior enhancements. Targeted upgrades often attract stronger buyers and higher pricing. We advise owners on the improvements that have the greatest impact in today’s Chicago multifamily market.

Why work with CREConsult for multifamily brokerage?

We specialize exclusively in Chicago-area multifamily sales. Our valuation accuracy, data-driven marketing, and active investor network consistently deliver higher pricing and stronger terms for sellers. We provide institutional-level execution with a client-focused, advisory approach.

Request a free valuation of your property

Be informed about your property’s value before making major financial decisions. Our expert valuations provide the insights you need to maximize your investment.