Overview

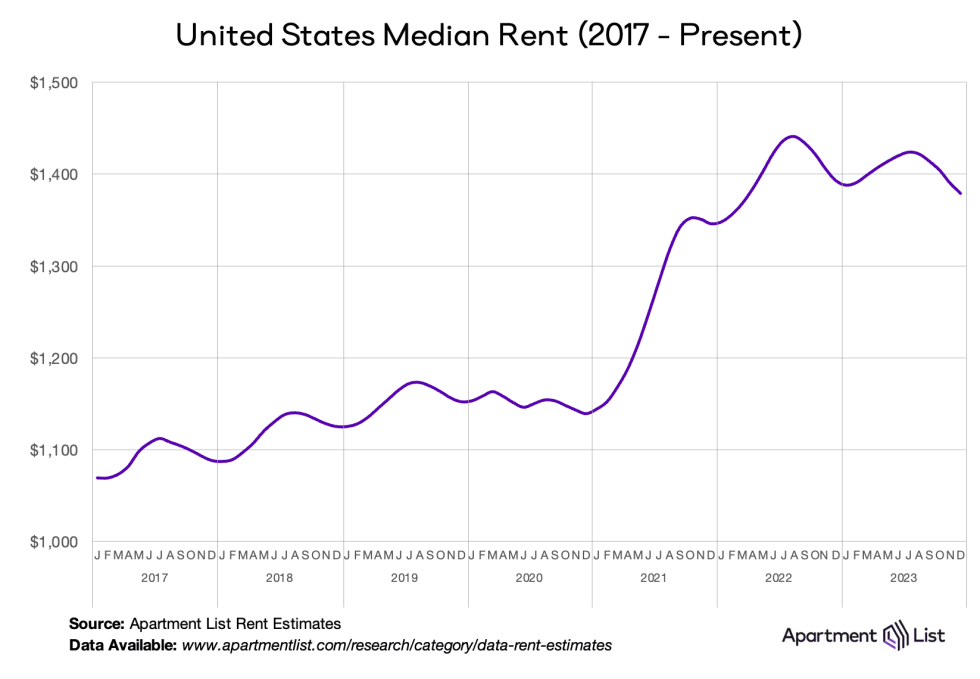

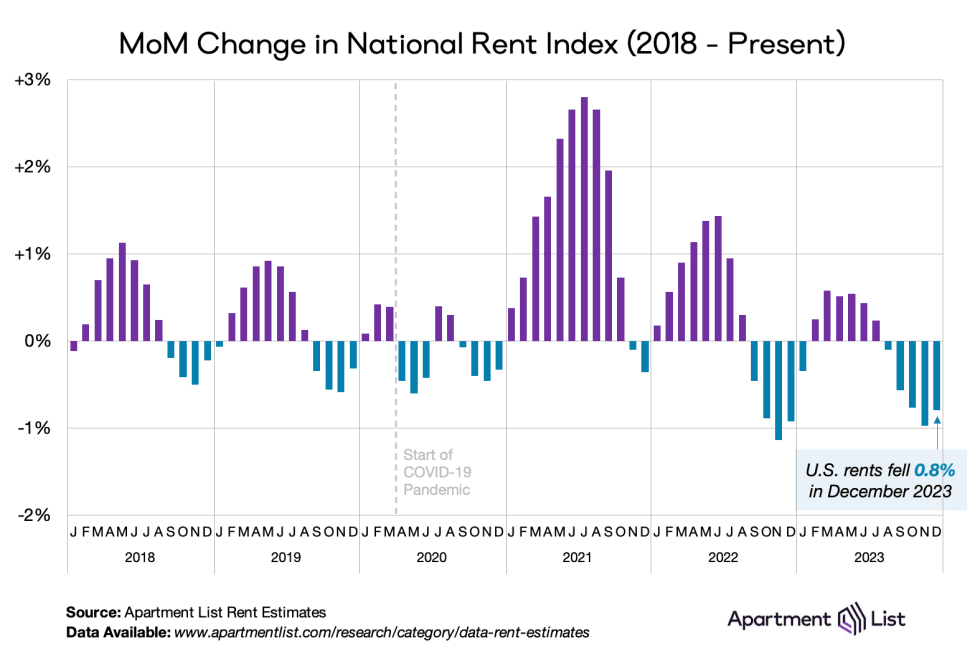

Happy New Year and welcome to the January 2024 Apartment List National Rent Report! The rental market closed out 2023 with a fifth straight month of negative rent growth, as the nationwide median rent fell by 0.8 percent to $1,379.1 The recent declines are in line with the rental market’s typical seasonal pattern, as fewer renters are looking to move at this time of year, although this year’s dip has been a bit sharper than what we normally see.

Year-over-year rent growth has bottomed out but remains in negative territory at -1 percent, meaning that on average, apartments across the country are slightly cheaper today than they were one year ago. This stands in sharp contrast to the prevailing conditions of 2021 and 2022, when rent prices were surging and year-over-year growth peaked at 18 percent nationally. But despite this cooldown, the national median rent is still nearly $250 per month higher than it was just three years ago.

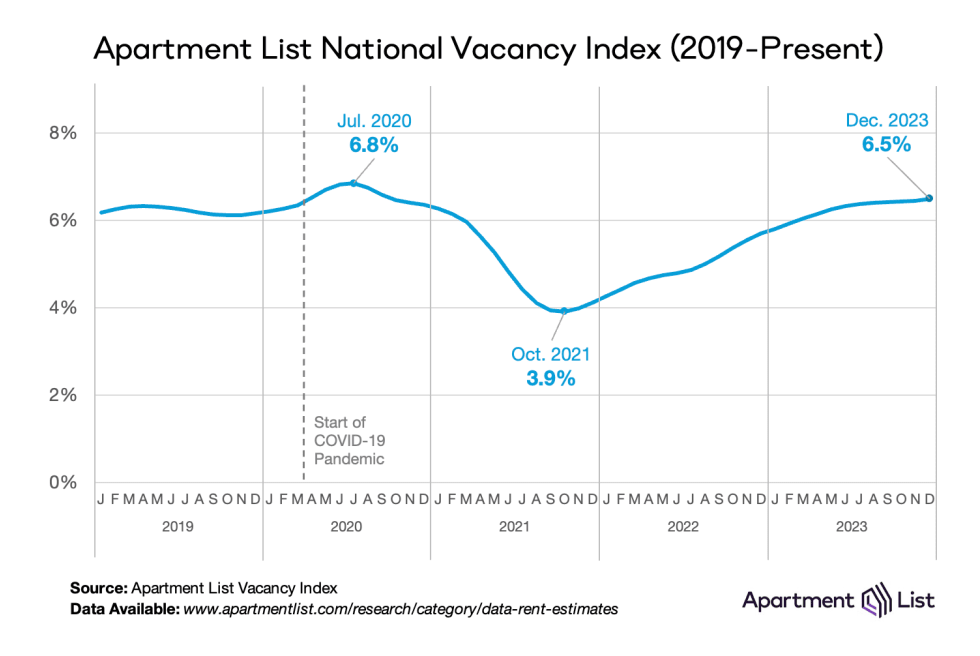

On the supply side of the market, our national vacancy index stands at 6.5 percent, slightly higher than the pre-pandemic average. This represents the culmination of vacancies gradually easing for two full years after a historic tightening in 2021. And with the construction pipeline of new apartments still near record levels, we expect that there will continue to be an abundance of vacant units on the market in the year ahead.

Regionally, rents fell in December in 83 of the nation’s 100 largest cities, and prices are down year-over-year in 60 of these 100 cities. The sharpest rent declines over the past year has been in Oakland, CA, where rents are down by 9.3% year-over-year. Atlanta, GA; Portland, OR; and Austin, TX have all also seen rents fall by more than 5 percent.

Rents are down 0.8% month-over-month, down 1% year-over-year

Rent growth follows a seasonal pattern – rent increases generally take place during the spring and summer, whereas the fall and winter usually see a modest price dip. We are now squarely in the midst of the rental market’s off-season, as reflected in recent price trends. Rents began to dip last August, and have now fallen for five straight months as of December’s 0.8 percent decline.

December’s decline was a bit more modest than the 1 percent dip that we saw in November. But this is also the second steepest December rent decline that we’ve seen in the history of our index (going back to 2017). The only time that December brought a sharper decline was in 2022, when rents fell by 0.9 percent as the market shifted into the period of sluggishness that still persists. For comparison, from 2017 to 2020, December declines averaged 0.3 percent.

On a year-over-year basis, rents nationally are down 1 percent. Year-over-year rent growth fell to zero in June for the first time since the early stages of the pandemic, and has now been in negative territory for seven consecutive months.

Over the course of 2023 as a whole, rents fell by 0.7 percent, making it the second weakest year of rent growth in our data, coming ahead of only 2020. For comparison, during the steady-state years of 2017 to 2019 before the pandemic, full year rent growth averaged 2.6 percent. After prices skyrocketed in 2021 and 2022, the pendulum swung back a bit in 2023 as price growth was kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market.

The rental market slowdown in finally reflected in inflation numbers

The primary measure of inflation in the United States is the Bureau of Labor Statistics’s Consumer Price Index (CPI), which is heavily influenced by changes in housing prices.2 The Apartment List National Rent Index has proven to be a strong leading indicator of the CPI housing and rent components, since our index captures price changes in new leases, which are only later reflected in price changes across all leases (what the CPI measures).

Because of these methodological differences, when our index peaked with record-setting rent growth in late 2021 (+17.8 percent), the CPI’s measure of household inflation was still in the early stages of its upswing. And while rent growth as measured by our index was cooling over the course of 2022, the CPI measure continued to rise. But as we had long been predicting, the shelter component of CPI finally turned the corner earlier this year and has now been steadily cooling for six months. As the official measure of shelter inflation continues to trend down, it will help overall inflation continue to ease along with it. While most components of inflation are difficult to predict, the Apartment List rent index can confidently tell us where shelter CPI is headed.

Apartment vacancies are back above pre-pandemic levels

The price fluctuations that have rocked the rental market over the past three years are largely attributable to changes in the balance between the number of vacant apartments available and the number of renters looking to move into them. Early in the pandemic, the Apartment List Vacancy Index rose to 6.8 percent as many Americans consolidated households and moved in with family amid large job losses and economic uncertainty. Then, a suddenly-tight rental market drove rapid rent growth in 2021 and 2022 as more households were competing for a dwindling supply of vacant units. Our vacancy index tightened rapidly from 6.8 percent to 3.9 percent in just over a year.

But after bottoming out in October 2021, our national vacancy index has been easing steadily for two full years. This easing has plateaued in recent months, but has not stopped entirely. In December, our vacancy index ticked up to 6.5 percent, the highest reading since September 2020. And there’s good reason to expect that it could rise even further in the year ahead. Despite a recent slowdown in new building permits being issued, the number of multifamily units under construction remains near record levels. As developers work through this robust construction pipeline, the supply of new apartment inventory should remain strong throughout 2024. This means that renters should have more available options than they have in some time, especially in the Sun Belt markets where construction activity has been strongest.

Vacancy trends are highly localized, and they have been a key indicator of rapidly evolving conditions in local markets across the U.S. throughout the pandemic. To explore the topic in greater detail, monthly vacancy data are now available for download for hundreds of cities, metros, and states, and can be easily linked to our existing rent estimates using Federal Information Processing System (FIPS) codes.

Rents down month-over-month in 83 of 100 largest cities, down year-over-year in 60

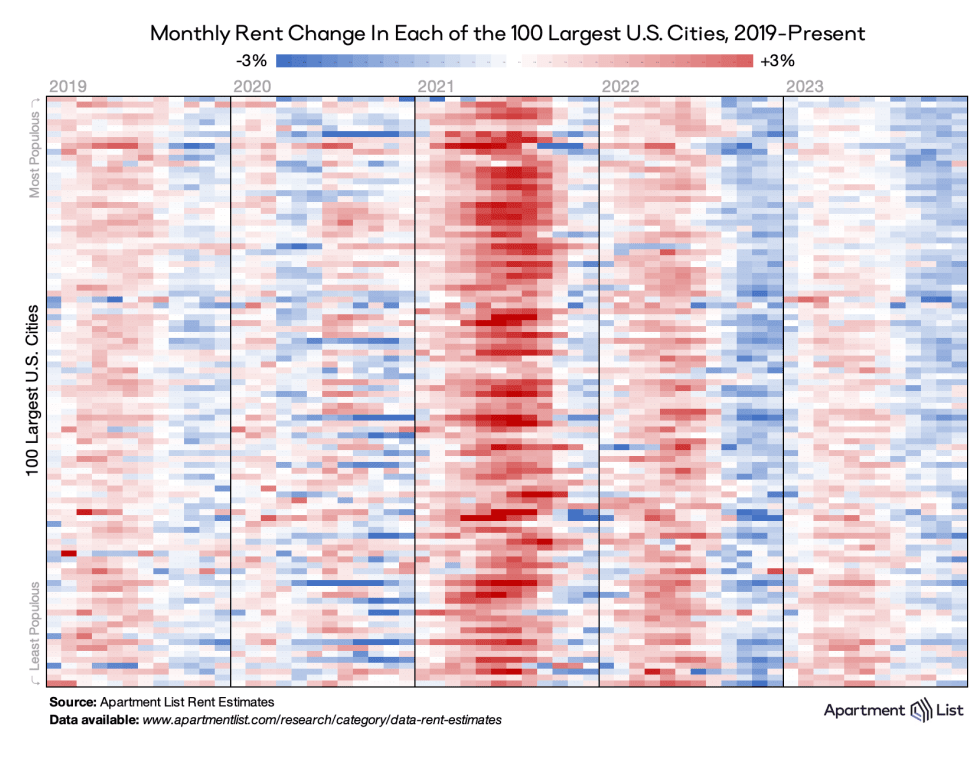

The chart below visualizes monthly rent changes in each of the nation’s 100 largest cities from January 2019 to present. The color in each cell represents the extent to which prices went up (red) or down (blue) in a given city in a given month. We see a typical seasonal pattern in 2019, followed by 2020, where horizontal bands of dark blue represent steep rent drops in some of the nation’s largest and most expensive cities. Meanwhile, the dark red bands in 2021 and 2022 represent the rent heatwave that drove up prices nationwide. But the rightmost columns of the chart show the rent cooldown in late 2022 and modest rent growth in 2023.

As nationwide rent growth was negative in December, so too was local rent growth in the majority of large cities across the county. 83 of the nation’s largest 100 cities saw prices fall month-over-month, and in 60 of these cities prices are down year-over-year.

In early 2022, all 100 of these cities were posting positive year-over-year rent increases. The first to turn negative were the early “zoom towns” in states like Arizona, Nevada, and Idaho that surged in popularity in 2020 when much of the nation’s workforce went remote, but saw a pullback in demand as affordable options dissipated and more jobs were called back to city centers. Since then, larger cities have joined the trend, including much of California and the West Coast, Texas, and the Southeast. Currently the sharpest year-over-year decline can be found in Oakland, CA, where prices are down 9.3 percent compared to last December.

New supply drives falling rents in Austin

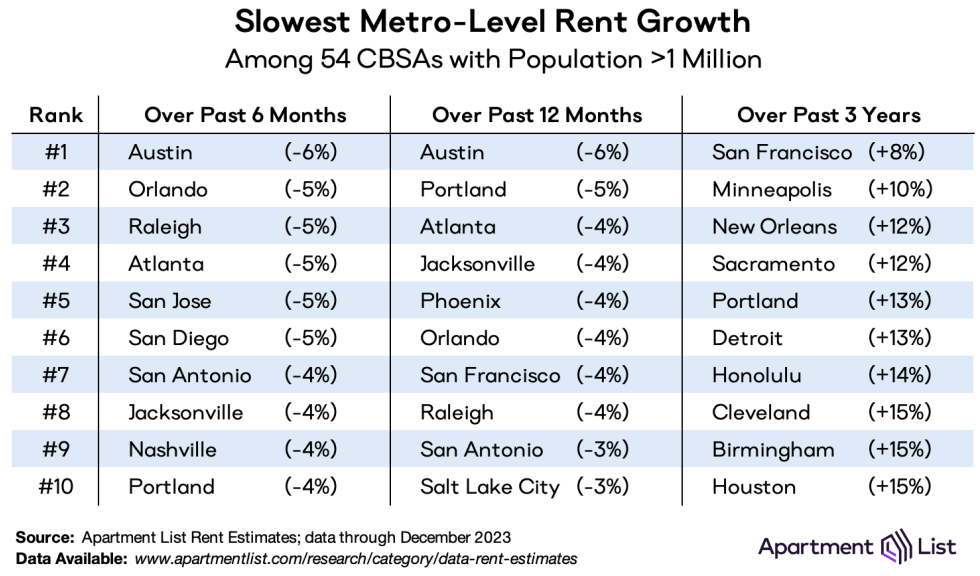

At the metro level, year-over-year rent declines are especially prevalent across Sun Belt metros, topped by Austin, where prices are down 6 percent in the last 12 months. The Austin metro is also significant for permitting new homes at the fastest pace of any large metro in the county, signaling the important role construction plays in managing long-term affordability. Atlanta, Jacksonville, Phoenix, Orlando, and Raleigh are other examples of Sun Belt metros whose year-over-year rent growth once peaked above 20 percent in 2021 but who now rank among the top 10 for fastest year-over-year declines.

The Portland and San Francisco metro areas are also experiencing some of the nation’s slowest year-over-year growth, showing that high-cost coastal metros are also seeing a slowdown in rental demand. These markets were among those that saw rapid declines in 2020, and are slowing again today, albeit less dramatically. The Portland metro in particular ranks in the top 10 for slowest rent growth over the past 6, 12, and 36 months, signaling that local rent growth has been slow for the entire pandemic period.

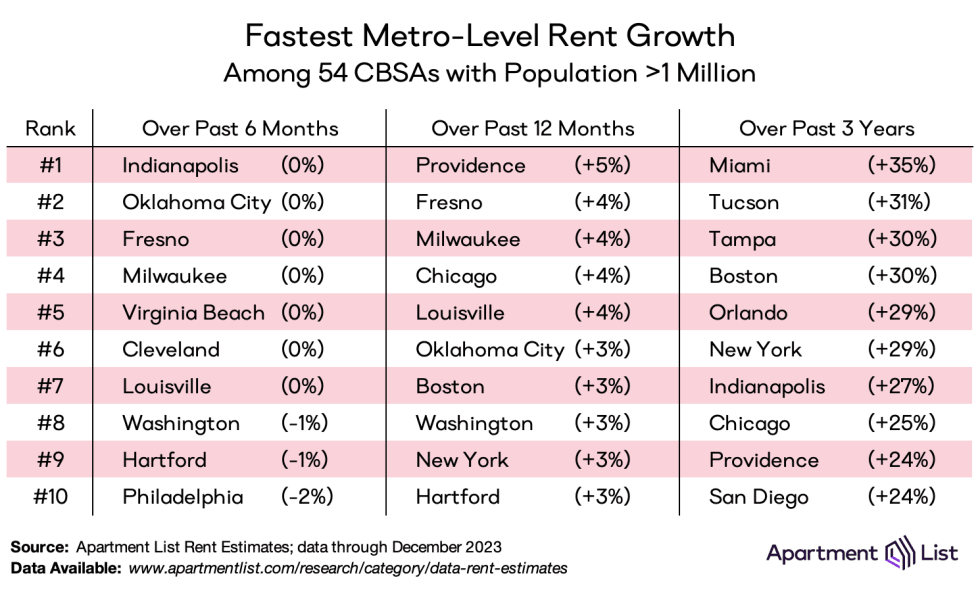

Midwestern and Northeastern markets have maintained positive rent growth

At the other end of the spectrum, the fastest rent growth has been occurring in metros across the Midwest and the Northeast. Most of the metros ranking high for rent growth over the past 6 and 12 months are located here. Providence leads the way for fastest year-over-year growth, highlighting how Rhode Island has become a popular destination, likely reflecting demand from renters who have been priced out of nearby Boston or possibly even New York City. That said, Boston, New York City, and Washington, D.C. all also rank among the top 10 for year-over-year growth, indicating that the major markets of the Northeast are drawing renters back.

Over the longer three-year period, the fastest rent growth is still found in the Sun Belt even as many metros there have cooled in 2023. The Miami metro tops the list with three-year rent growth of 35 percent, while the Tucson and Tampa metros round out the top three.

Conclusion

December’s 0.8 percent rent decline continues the rental market’s winter dip, and keeps year-over-year rent growth in the negative at -1 percent. Our national rent index is likely to fall for at least one more month before rebounding in line with the market’s typical seasonality. Looking further ahead, a robust construction pipeline should drive strong supply growth throughout 2024. On the other hand, the extent to which demand rebounds or remains sluggish will likely depend on broader macroeconomic conditions.

For complete data, explore the interactive map below or head over to our rental data page, where you can download the most recent estimates for your city, as well as historic data going back to 2017. And as always, feel free to contact us with any questions!

A Note on Our Methodology

Apartment List has long been committed to making our data products as accurate and transparent as possible. Our rent estimates and vacancy index are calculated as follows:

Rent Estimates: We estimate rent growth using a same-unit approach that controls for compositional changes in the rental stock. We also control for price fluctuations that arise over the course of a vacancy by identifying the last available list price before a unit gets rented as a proxy for its transacted price. Finally, we combat luxury bias in our rent data by benchmarking our reported rent levels to fully-representative median rent statistics from the Census Bureau’s American Community Survey.

Vacancy Index: Our real-time availability data allows us to calculate a daily vacancy rate for each of our partner properties, which we then average over the course of each month to calculate a monthly rate. Our overall index is an average of these property-level vacancy rates, weighted by the number of units in each property. We restrict our sample to properties that have been on Apartment List for at least six months and that have attained a stabilized vacancy rate of 15% or less.

Source: Apartment List National Rent Report

Receive Market Insights

Periodic analysis on rents, pricing, cap rates, and transaction activity across Chicago and key suburban markets.